Last Updated:

Forex Broker is an essential factor in determining the success of your trading. Many available retail forex brokers offer their services online. Not all of them are easy to work with or suitable for your trading needs. In this guide, we have identified some important key areas you should consider when choosing the best forex broker for yourself.

We have created a little custom GTP from OpenAi. You can get a try here to find out the best Forex Broker using AI.

Top Forex Brokers You Should Know In 2024

Before indulging yourself with our ultimate guide on forex brokers, we have prepared a quick list of the best forex brokers in 2024 for your digestion.

Regulated Brokers

| Rank | Broker Name | Regulators | Maximum Leverage |

|---|---|---|---|

| #1 | XM | ASIC (Australia), CySEC (Cyprus), DFSA (United Arab Emirates), FSC (Belize) | 1:1000 |

| #2 | FP Markets | ASIC (Australia), CySEC (Cyprus) | 1:500 |

| #3 | FBS | CySEC (Cyprus), FSC (Belize) | 1:3000 |

| #4 | HFM | CySEC (Cyprus), DFSA (United Arab Emirates), FCA (United Kingdom), FSA (Seychelles), FSCA (South Africa) | 1:1000 |

| #5 | AximTrade | ASIC (Australia) | 1:3000 |

| #6 | Axiory | FSC (Belize) | 1:777 |

| #7 | Number One Capital Markets | VFSC (Vanuatu) | 1:1000 |

| #8 | PrimeXBT | ASIC (Australia) | 1:1000 |

| #9 | Rakuten Securities | ASIC (Australia), FSA (Japan), SFC (Hong Kong) | 1:400 |

| #10 | Exness | CySEC (Cyprus), FCA (United Kingdom), FSA (Seychelles), FSC (The British Virgin Islands), FSC (Mauritius), FSCA (South Africa) | 1:1000000 |

| #11 | eToro | ADGM FSRA (Abu Dhabi), ASIC (Australia), CySEC (Cyprus), FCA (United Kingdom), FSA (Seychelles) | 1:400 |

| #12 | Oanda | FSC (The British Virgin Islands) | 1:200 |

| #13 | IG | AMF (France), ASIC (Australia), DFSA (United Arab Emirates), FCA (United Kingdom), FMA (New Zealand), FSA (Japan), MAS (Singapore), NFA (United States) | 1:30 |

| #14 | IC Markets | ASIC (Australia), CySEC (Cyprus), FSA (Seychelles) | 1:1000 |

| #15 | VantageMarkets | ASIC (Australia), CIMA (Cayman Islands), FCA (United Kingdom), VFSC (Vanuatu) | 1:500 |

| #16 | Forex Capital Markets | ASIC (Australia), CySEC (Cyprus), FCA (United Kingdom), FSCA (South Africa) | 1:1000 |

| #17 | AvaTrade | ADGM FSRA (Abu Dhabi), ASIC (Australia), CBI (Ireland) , CySEC (Cyprus), FFAJ (Japan), FSA (Japan), FSC (The British Virgin Islands), FSCA (South Africa), ISA (Israel), KNF (Poland) | 1:400 |

| #18 | FOREX.com | ASIC (Australia), CIMA (Cayman Islands), FCA (United Kingdom), FSA (Japan), IIROC (Canada), MAS (Singapore), NFA (United States) | 1:200 |

| #19 | Trade Nation | ASIC (Australia), FCA (United Kingdom), SCB (Bahamas) | 1:200 |

| #20 | GO Markets | ASIC (Australia), CySEC (Cyprus), FSA (Seychelles), FSC (Mauritius) | 1:500 |

| #21 | easyMarkets | ASIC (Australia), CySEC (Cyprus), FSA (Seychelles), FSC (The British Virgin Islands) | 1:2000 |

| #22 | Pepperstone | ASIC (Australia), CySEC (Cyprus), DFSA (United Arab Emirates), FCA (United Kingdom), SCB (Bahamas) | 1:500 |

| #23 | Eightcap | ASIC (Australia), CySEC (Cyprus), FCA (United Kingdom), SCB (Bahamas) | 1:500 |

| #24 | Binary.com | FSC (The British Virgin Islands), LFSA (Malaysia), VFSC (Vanuatu) | 1:1000 |

| #25 | FXTRADING.com | ASIC (Australia), VFSC (Vanuatu) | 1:500 |

| #26 | Spreadex | FCA (United Kingdom) | 1:30 |

| #27 | ATFX | ASIC (Australia), CySEC (Cyprus), FCA (United Kingdom), FSA (Seychelles), FSC (Mauritius), JSC (Jordan), SCA (United Arab Emirates) | 1:400 |

| #28 | HYCM | CIMA (Cayman Islands), CySEC (Cyprus), DFSA (United Arab Emirates), FCA (United Kingdom) | 1:500 |

| #29 | ActivTrades | CMVM (Portugal), FCA (United Kingdom), SCB (Bahamas) | 1:400 |

| #30 | Decode Global | ASIC (Australia), VFSC (Vanuatu) | 1:500 |

| #31 | ETO Markets | ASIC (Australia), FSA (Seychelles) | 1:500 |

| #32 | Trading212 | CySEC (Cyprus), FCA (United Kingdom) | 1:30 |

| #33 | STARTRADER | ASIC (Australia), FCA (United Kingdom), FSA (Seychelles), FSCA (South Africa) | 1:500 |

| #34 | RoboForex | CySEC (Cyprus), FSC (Belize), NBRB (Belarus) | 1:2000 |

| #35 | Prospero | ASIC (Australia) | 1:400 |

| #36 | BUX Markets | CySEC (Cyprus), FCA (United Kingdom) | 1:30 |

| #37 | Squared Financial | BDF (France) , BaFin (Germany) , CNMV (Spain), CySEC (Cyprus), FSA (Seychelles) | 1:500 |

| #38 | BCR | ASIC (Australia), FSC (The British Virgin Islands) | 1:400 |

| #39 | Tier1FX | MFSA (Malta) | 1:200 |

| #40 | Fortune Prime Global | ASIC (Australia), VFSC (Vanuatu) | 1:500 |

| #41 | Quadcode Markets | ASIC (Australia), CySEC (Cyprus), SCB (Bahamas) | 1:200 |

| #42 | ThinkMarkets | ASIC (Australia), CIMA (Cayman Islands), CySEC (Cyprus), FCA (United Kingdom), FSA (Japan), FSA (Seychelles), FSC (Mauritius), FSCA (South Africa) | 1:500 |

| #43 | FxPro | CySEC (Cyprus), FCA (United Kingdom), FSC (Mauritius), FSCA (South Africa), SCB (Bahamas) | 1:200 |

| #44 | Fortrade | ASIC (Australia), CySEC (Cyprus), FCA (United Kingdom), FSC (Mauritius), IIROC (Canada), NBRB (Belarus) | 1:200 |

| #45 | TMGM | ASIC (Australia), FMA (New Zealand), VFSC (Vanuatu) | 1:30 |

| #46 | Tickmill | CySEC (Cyprus), DFSA (United Arab Emirates), FCA (United Kingdom), FSA (Seychelles), FSCA (South Africa), LFSA (Malaysia) | 1:500 |

| #47 | BDSwiss | FSA (Seychelles), FSC (Mauritius) | 1:500 |

| #48 | OctaFX | CySEC (Cyprus) | 1:500 |

| #49 | Anzo Capital | FCA (United Kingdom), FSC (Belize) | 1:1000 |

| #50 | AUS Global | ASIC (Australia), CySEC (Cyprus) | 1:500 |

| #51 | GMI | FCA (United Kingdom), FSC (Mauritius) | 1:2000 |

| #52 | IronFX | CySEC (Cyprus), FCA (United Kingdom) | 1:30 |

| #53 | INFINOX | FCA (United Kingdom), FSC (Mauritius), SCB (Bahamas) | 1:1000 |

| #54 | Trive | FSCA (South Africa), MFSA (Malta) | 1:30 |

| #55 | VT Markets | FSCA (South Africa) | 1:500 |

| #56 | JDR | ASIC (Australia), FSPR (New Zealand) | 1:400 |

| #57 | Scope Markets | CySEC (Cyprus), FSA (Seychelles), FSC (Belize) | 1:2000 |

| #58 | DCFX | BAPPEBTI (Indonesia) , FCA (United Kingdom), JFX (Indonesia), MAS (Singapore) | 1:1000 |

| #59 | FairMarkets | ASIC (Australia), FSC (Mauritius) | 1:1000 |

| #60 | NessFx | CySEC (Cyprus) | 1:500 |

| #61 | London Capital Group | FCA (United Kingdom), SCB (Bahamas) | 1:200 |

| #62 | Taurex | FCA (United Kingdom), FSA (Seychelles) | 1:1000 |

| #63 | Colmex Pro | CySEC (Cyprus) | 1:200 |

| #64 | ADS Securities | FCA (United Kingdom), SCA (United Arab Emirates) | 1:500 |

| #65 | Fusion Markets | ASIC (Australia), FSA (Seychelles), VFSC (Vanuatu) | 1:500 |

| #66 | ACY Securities | ASIC (Australia) | 1:500 |

| #67 | EBC | ASIC (Australia), FCA (United Kingdom) | 1:500 |

| #68 | nextmarkets | MFSA (Malta) | 1:30 |

| #69 | Hantec Markets | ASIC (Australia), CGSE (Hong Kong), FCA (United Kingdom), FSC (Mauritius), JSC (Jordan) | 1:1000 |

| #70 | CAPEX | ADGM FSRA (Abu Dhabi), ASF (Romania), CNMV (Spain), CySEC (Cyprus), FSA (Seychelles), FSCA (South Africa) | 1:300 |

| #71 | Dukascopy Bank | FINMA (Switzerland), FSA (Japan) | 1:200 |

| #72 | TrioMarkets | CySEC (Cyprus), FSC (Mauritius) | 1:500 |

| #73 | GBE brokers | BaFin (Germany) , CySEC (Cyprus) | 1:400 |

| #74 | AETOS Capital Group | ASIC (Australia), FCA (United Kingdom), VFSC (Vanuatu) | 1:400 |

| #75 | Xtrade | ASIC (Australia), FSC (Belize), FSCA (South Africa) | 1:400 |

| #76 | Windsor Brokers | CMA (Kenya), CySEC (Cyprus), FSA (Seychelles), FSC (Belize), FSC (The British Virgin Islands), JSC (Jordan) | 1:1000 |

| #77 | FIBO Group | BaFin (Germany) , CySEC (Cyprus), FSC (The British Virgin Islands) | 1:1000 |

| #78 | OEXN | CySEC (Cyprus), FSC (Mauritius) | 1:1000 |

| #79 | ZFX | FCA (United Kingdom), FSA (Seychelles) | 1:2000 |

| #80 | Ultima Markets | ASIC (Australia), CySEC (Cyprus), FSC (Mauritius) | 1:2000 |

| #81 | AccuIndex | CySEC (Cyprus), FSC (Mauritius) | 1:400 |

| #82 | LiteFinance | CySEC (Cyprus) | 1:1000 |

| #83 | Acetop Financial | FCA (United Kingdom) | 1:30 |

| #84 | TopFX | CySEC (Cyprus), FSA (Seychelles) | 1:1000 |

| #85 | Skilling | CySEC (Cyprus), FSA (Seychelles) | 1:1000 |

| #86 | Mitrade | ASIC (Australia), CIMA (Cayman Islands), FSC (Mauritius) | 1:200 |

| #87 | Victory International Futures | BAPPEBTI (Indonesia) , ICDX (Indonesia) | 1:100 |

| #88 | Valutrades | FCA (United Kingdom), FSA (Seychelles) | 1:500 |

| #89 | Spread Co | FCA (United Kingdom) | 1:30 |

| #90 | FXTM | CMA (Kenya), CySEC (Cyprus), FCA (United Kingdom), FSC (Mauritius), FSCA (South Africa) | 1:2000 |

| #91 | DIDIMAX | BAPPEBTI (Indonesia) , JFX (Indonesia) | 1:400 |

| #92 | TradersTrust | CySEC (Cyprus), FSA (Seychelles) | 1:3000 |

| #93 | Sky Alliance Markets | ASIC (Australia) | 1:400 |

| #94 | IEXS | ASIC (Australia), FCA (United Kingdom), FINTRAC (Canada) | 1:800 |

| #95 | PRCBroker | CySEC (Cyprus), VFSC (Vanuatu) | 1:100 |

| #96 | Land-FX | FCA (United Kingdom) | 1:2000 |

| #97 | FXORO | CNMV (Spain), CySEC (Cyprus), FSA (Seychelles) | 1:400 |

| #98 | ForexMart | FCA (United Kingdom), FSC (The British Virgin Islands) | 1:3000 |

| #99 | Darwinex | CNMV (Spain), FCA (United Kingdom) | 1:200 |

| #100 | OBR Investments | CySEC (Cyprus) | 1:400 |

| #101 | ALB | MFSA (Malta) | 1:200 |

| #102 | InterStellar Group | CySEC (Cyprus), FSA (Seychelles) | 1:500 |

| #103 | Mohican Markets | ASIC (Australia), FINTRAC (Canada), VFSC (Vanuatu) | 1:400 |

| #104 | Conotoxia | CySEC (Cyprus) | 1:300 |

| #105 | ATC Brokers | CIMA (Cayman Islands), FCA (United Kingdom) | 1:200 |

| #106 | OneRoyal | ASIC (Australia), CySEC (Cyprus), VFSC (Vanuatu) | 1:1000 |

| #107 | Capital Index | FCA (United Kingdom), SCB (Bahamas) | 1:200 |

| #108 | Merlion Global | FSC (Mauritius), SECC (Cambodia) | 1:500 |

| #109 | EC Markets | ASIC (Australia), FCA (United Kingdom), FMA (New Zealand), FSA (Seychelles), FSC (Mauritius) | 1:500 |

| #110 | FTM Brokers | NBRB (Belarus) | 1:200 |

| #111 | Oqtima | CySEC (Cyprus), FSA (Seychelles) | 1:500 |

| #112 | M4Markets | CySEC (Cyprus), DFSA (United Arab Emirates), FSA (Seychelles) | 1:5000 |

| #113 | Libertex | CySEC (Cyprus), FSC (Mauritius) | 1:999 |

| #114 | Geldex Invest | CySEC (Cyprus) | 1:100 |

| #115 | Orbex | CySEC (Cyprus), FSC (Mauritius) | 1:500 |

| #116 | Orfinex | ASIC (Australia), FSC (Mauritius), FinCEN (United States) | 1:500 |

| #117 | Investing24 | CySEC (Cyprus) | 1:500 |

| #118 | BlackBull Markets | FMA (New Zealand), FSA (Seychelles) | 1:500 |

| #119 | Trading Pro | FSCA (South Africa) | 1:2000 |

| #120 | MEX Exchange | ASIC (Australia) | 1:500 |

| #121 | 4T | FCA (United Kingdom), FSA (Seychelles) | 1:300 |

| #122 | One Financial Markets | FCA (United Kingdom), FSCA (South Africa) | 1:400 |

| #123 | Ox Securities | ASIC (Australia) | 1:500 |

| #124 | Auric International Markets | ASIC (Australia), LFSA (Malaysia) | 1:400 |

| #125 | JustMarkets | CySEC (Cyprus), FSA (Seychelles), FSC (Mauritius) | 1:3000 |

| #126 | Long Asia | ASIC (Australia), FINTRAC (Canada) | 1:500 |

| #127 | NSFX | MFSA (Malta) | 1:50 |

| #128 | XBMarkets | CySEC (Cyprus) | 1:200 |

| #129 | XtreamForex | FSC (Mauritius) | 1:1000 |

| #130 | RockGlobal | FMA (New Zealand) | 1:500 |

| #131 | Axi | ASIC (Australia), DFSA (United Arab Emirates), FCA (United Kingdom) | 1:500 |

| #132 | Global Trade Capital | FCA (United Kingdom), FSC (Mauritius), SCA (United Arab Emirates), VFSC (Vanuatu) | 1:1000 |

| #133 | TDX Global | ASIC (Australia), FinCEN (United States) | 1:500 |

| #134 | ICM | ADGM FSRA (Abu Dhabi), FCA (United Kingdom), FSC (Mauritius), FSCA (South Africa), LFSA (Malaysia) | 1:200 |

| #135 | DLS Markets | ASIC (Australia), VFSC (Vanuatu) | 1:1000 |

| #136 | National Coin Exchange | ASIC (Australia), FSA (Seychelles) | 1:1000 |

| #137 | IGM Forex | CySEC (Cyprus) | 1:400 |

| #138 | iFOREX | CySEC (Cyprus), FSC (The British Virgin Islands) | 1:400 |

| #139 | CXM Trading | FCA (United Kingdom), FSC (Mauritius) | 1:1000 |

| #140 | eurotrader | CySEC (Cyprus), FCA (United Kingdom), FSCA (South Africa) | 1:500 |

| #141 | Doto | CySEC (Cyprus), FSA (Seychelles), FSC (Mauritius), FSCA (South Africa) | 1:500 |

| #142 | Just2Trade | CySEC (Cyprus) | 1:500 |

| #143 | Markets.com | ASIC (Australia), CySEC (Cyprus), FCA (United Kingdom), FSC (The British Virgin Islands), FSCA (South Africa) | 1:300 |

| #144 | IQ Option | CySEC (Cyprus) | 1:500 |

| #145 | ForexBY | NBRB (Belarus) | 1:200 |

| #146 | LegacyFX | CySEC (Cyprus), VFSC (Vanuatu) | 1:200 |

| #147 | YaMarkets | FSC (Mauritius), VFSC (Vanuatu) | 1:1000 |

| #148 | Tradeview Markets | CIMA (Cayman Islands), LFSA (Malaysia) | 1:400 |

| #149 | RightFX | FSC (Mauritius) | 1:500 |

| #150 | MogaFX | ASIC (Australia) | 1:500 |

| #151 | Pacific Financial Derivatives | FMA (New Zealand) | 1:300 |

| #152 | Amega | FSC (Mauritius) | 1:1000 |

| #153 | TradeEU | CySEC (Cyprus) | 1:30 |

| #154 | Soho Markets | CySEC (Cyprus), FSC (Mauritius) | 1:500 |

| #155 | Phillip Nova | MAS (Singapore) | 1:20 |

| #156 | XTrend | CySEC (Cyprus) | 1:300 |

| #157 | Trust Capital | CySEC (Cyprus) | 1:400 |

| #158 | Crib Markets | FSC (Mauritius) | 1:500 |

| #159 | FX Central Clearing | CySEC (Cyprus) | 1:500 |

| #160 | T4Trade | FSA (Seychelles) | 1:1000 |

| #161 | InterTrader | FCA (United Kingdom) | 1:30 |

| #162 | Eight Plus | CySEC (Cyprus) | 1:100 |

| #163 | ATG WORLD | FSA (Seychelles) | 1:500 |

| #164 | Equiti | FSA (Seychelles) | 1:2000 |

| #165 | Ngel Partners | LFSA (Malaysia) | 1:200 |

| #166 | LeoPrime | FSA (Seychelles) | 1:1000 |

| #167 | TeraFX | FCA (United Kingdom) | 1:500 |

| #168 | IFC Markets | FSC (The British Virgin Islands) | 1:400 |

| #169 | Axon Markets | FSA (Seychelles) | 1:2000 |

| #170 | Titan FX | FSA (Seychelles), FSC (The British Virgin Islands), FSC (Mauritius), VFSC (Vanuatu) | 1:1000 |

| #171 | Goldwell Capital | ASIC (Australia), SECC (Cambodia) | 1:200 |

| #172 | Errante | CySEC (Cyprus), FSA (Seychelles) | 1:500 |

| #173 | IUX Markets | FSCA (South Africa), MISA (Comoros) | 1:3000 |

| #174 | DNA Markets | ASIC (Australia) | 1:500 |

| #175 | Forex4you | FSC (The British Virgin Islands) | 1:2000 |

| #176 | SECURCAP | FSA (Seychelles) | 1:1000 |

| #177 | Axion Trade | ASIC (Australia) | 1:500 |

| #178 | Alchemy Prime | FCA (United Kingdom) | 1:200 |

| #179 | FXCentrum | FSA (Seychelles) | 1:1000 |

| #180 | Global Femic Services | ASIC (Australia) | 1:500 |

| #181 | ZaraFX | FINTRAC (Canada), FSC (Mauritius) | 1:500 |

| #182 | OnEquity | FSA (Seychelles), FSCA (South Africa) | 1:500 |

| #183 | Rock-West | FSA (Seychelles) | 1:1000 |

| #184 | FXOpulence | ASIC (Australia) | 1:500 |

| #185 | FinPros | FSA (Seychelles) | 1:500 |

| #186 | Connext | FSA (Seychelles) | 1:1000 |

| #187 | JMI | VFSC (Vanuatu) | 1:500 |

| #188 | Market Equity | LFSA (Malaysia), VFSC (Vanuatu) | 1:500 |

| #189 | FxGrow | CySEC (Cyprus), VFSC (Vanuatu) | 1:100 |

| #190 | CMS Prime | FSC (Mauritius) | 1:500 |

| #191 | AAAFx | FSCA (South Africa) | 1:500 |

| #192 | xChief | MISA (Comoros), VFSC (Vanuatu) | 1:1000 |

| #193 | TradeWill | ASIC (Australia) | 1:500 |

| #194 | Gerchik & Co | VFSC (Vanuatu) | 1:100 |

| #195 | Venn Prime Securities | LFSA (Malaysia) | 1:100 |

| #196 | AccentForex | VFSC (Vanuatu) | 1:500 |

| #197 | Golden Brokers | LFSA (Malaysia) | 1:100 |

| #198 | Radex Markets | FSA (Seychelles) | 1:500 |

| #199 | Exclusive Markets | FSA (Seychelles) | 1:2000 |

| #200 | Main Group FX | ASIC (Australia) | 1:30 |

| #201 | ClickTrades | FSA (Seychelles) | 1:300 |

| #202 | Trade Quo | FSA (Seychelles) | 1:1000 |

| #203 | Vstar | CySEC (Cyprus), FSC (Mauritius) | 1:200 |

| #204 | ForexTB | CySEC (Cyprus) | 1:400 |

| #205 | Sway Markets | ASIC (Australia) | 1:500 |

| #206 | Monaxa | ASIC (Australia) | 1:2000 |

| #207 | DB Investing | FSA (Seychelles) | 1:1000 |

| #208 | Cerus Markets | LFSA (Malaysia) | 1:400 |

| #209 | 3angleFX | CySEC (Cyprus) | 1:30 |

| #210 | ThreeTrader | VFSC (Vanuatu) | 1:500 |

| #211 | Mugan Markets | FSCA (South Africa) | 1:500 |

| #212 | Thunder Markets | FSA (Seychelles) | 1:400 |

| #213 | Exfor | LFSA (Malaysia) | 1:500 |

| #214 | Opofinance | FSA (Seychelles) | 1:2000 |

| #215 | Juno Markets | ASIC (Australia), VFSC (Vanuatu) | 1:1000 |

| #216 | Switch Markets | ASIC (Australia) | 1:500 |

| #217 | SuperForex | FSC (Belize) | 1:2000 |

| #218 | IFX Brokers | FSCA (South Africa) | 1:1000 |

| #219 | AC FOREX | FSA (Seychelles) | 1:500 |

| #220 | TNFX | FSA (Seychelles) | 1:500 |

| #221 | Trade View | FSA (Seychelles) | 1:500 |

| #222 | CM Trading | FSA (Seychelles), FSCA (South Africa) | 1:200 |

| #223 | Garnet Trade | ASIC (Australia) | 1:500 |

| #224 | Alpho | FSA (Seychelles) | 1:500 |

| #225 | Finq | FSA (Seychelles) | 1:300 |

| #226 | SWmarkets | VFSC (Vanuatu) | 1:200 |

| #227 | AdroFx | VFSC (Vanuatu) | 1:500 |

| #228 | HonorFX | FSC (Mauritius), LFSA (Malaysia) | 1:500 |

| #229 | Axia Investments | FSA (Seychelles) | 1:400 |

| #230 | Purple Trading | CySEC (Cyprus), FCA (United Kingdom) | 1:500 |

| #231 | Kwakol Markets | ASIC (Australia), FINTRAC (Canada) | 1:1000 |

| #232 | 77markets | FSA (Seychelles) | 1:300 |

| #233 | Vida Markets | FSCA (South Africa) | 1:1000 |

| #234 | OnePro | FSC (Mauritius), FSPR (New Zealand) | 1:500 |

| #235 | 4xHub | LFSA (Malaysia) | 1:100 |

| #236 | Blueberry Markets | ASIC (Australia) | 1:500 |

| #237 | XTB | CNMV (Spain), CySEC (Cyprus), FCA (United Kingdom), FSC (Belize) | 1:30 |

| #238 | TD Markets | FSCA (South Africa) | 1:500 |

| #239 | Plus500 | ASIC (Australia), CySEC (Cyprus), DFSA (United Arab Emirates), FCA (United Kingdom), FMA (New Zealand), FSA (Seychelles), FSCA (South Africa), MAS (Singapore) | 1:300 |

| #240 | InstaForex | CySEC (Cyprus), FSC (The British Virgin Islands) | 1:1000 |

| #241 | JDFX | FSPR (New Zealand) | 1:400 |

| #242 | Invest Markets | FSC (Belize) | 1:500 |

| #243 | TOP1 Markets | ASIC (Australia) | 1:1000 |

| #244 | GeneTrade | FSC (Belize) | 1:1000 |

| #245 | FXGlobe | FSCA (South Africa), VFSC (Vanuatu) | 1:500 |

| #246 | PrimeX Brokers | FSCA (South Africa) | 1:500 |

| #247 | Capital.Com | ASIC (Australia), CySEC (Cyprus), FCA (United Kingdom), FSA (Seychelles), NBRB (Belarus), SCB (Bahamas) | 1:30 |

| #248 | FXGT.com | CySEC (Cyprus), FSA (Seychelles), FSCA (South Africa), VFSC (Vanuatu) | 1:1000 |

| #249 | Dollars Markets | FSC (Mauritius) | 1:2000 |

| #250 | HTFX | CySEC (Cyprus), FCA (United Kingdom) | 1:500 |

| #251 | FXPIG | VFSC (Vanuatu) | 1:500 |

| #252 | CMC Markets | ASIC (Australia), BaFin (Germany) , FCA (United Kingdom), FMA (New Zealand), IIROC (Canada), MAS (Singapore) | 1:30 |

| #253 | tegasFX | VFSC (Vanuatu) | 1:200 |

| #254 | GoDo CM | FSC (Mauritius), SCA (United Arab Emirates) | 1:1000 |

| #255 | FXPrimus | CySEC (Cyprus), VFSC (Vanuatu) | 1:1000 |

| #256 | YADIX | FSA (Seychelles) | 1:1000 |

| #257 | Baazex | FSA (Seychelles) | 1:400 |

| #258 | FXOpen | CySEC (Cyprus), FCA (United Kingdom) | 1:500 |

| #259 | FinmaxFX | VFSC (Vanuatu) | 1:200 |

| #260 | Crystal Ball Markets | FINTRAC (Canada) | 1:1000 |

| #261 | Admiral Markets | ASIC (Australia), CMA (Kenya), CySEC (Cyprus), FCA (United Kingdom), FSA (Seychelles), FSCA (South Africa), JSC (Jordan) | 1:500 |

| #262 | Hirose Financial | FCA (United Kingdom), FSA (Japan), LFSA (Malaysia) | 1:30 |

| #263 | MultiBank Group | ASIC (Australia), BaFin (Germany) , CIMA (Cayman Islands), CySEC (Cyprus), FMA (Austria), FSC (The British Virgin Islands), MAS (Singapore), SCA (United Arab Emirates), VFSC (Vanuatu) | 1:500 |

| #264 | LIRUNEX | AMF (France), BaFin (Germany) , CNMV (Spain), CySEC (Cyprus), LFSA (Malaysia) | 1:2000 |

| #265 | Global Markets Group | FCA (United Kingdom) | 1:100 |

| #266 | CWG Markets | FCA (United Kingdom), VFSC (Vanuatu) | 1:1000 |

| #267 | Key to Markets | CySEC (Cyprus), FCA (United Kingdom), FSC (Mauritius) | 1:500 |

| #268 | JFD Brokers | BDF (France) , BaFin (Germany) , CNMV (Spain), CySEC (Cyprus), VFSC (Vanuatu) | 1:400 |

| #269 | Cabana Capitals | FSC (Mauritius), FSCA (South Africa) | 1:500 |

| #270 | Capital Street FX | FSC (Mauritius) | 1:10000 |

| #271 | VARIANSE | FCA (United Kingdom), FSC (Mauritius), LFSA (Malaysia) | 1:500 |

| #272 | We Connect Global | CGSE (Hong Kong), FINTRAC (Canada) | 1:200 |

| #273 | INGOT Brokers | ASIC (Australia), CMA (Kenya), FSA (Seychelles), JSC (Jordan) | 1:500 |

| #274 | LION | CIMA (Cayman Islands), MAS (Singapore), SFC (Hong Kong) | 1:400 |

| #275 | CapitalXtend | FSC (Mauritius) | 1:5000 |

| #276 | Blackwell Global | FCA (United Kingdom), SCB (Bahamas), SFC (Hong Kong) | 1:200 |

| #277 | MIFX | BAPPEBTI (Indonesia) , ICDX (Indonesia), JFX (Indonesia) | 1:100 |

| #278 | AAATrade | BaFin (Germany) , CySEC (Cyprus) | 1:200 |

| #279 | Global Prime | ASIC (Australia), FSA (Seychelles), VFSC (Vanuatu) | 1:100 |

| #280 | Focus Markets | ASIC (Australia) | 1:30 |

| #281 | CPT Markets | FCA (United Kingdom), FSC (Belize), FSCA (South Africa) | 1:500 |

| #282 | NAGA | BaFin (Germany) , CNMV (Spain), CONSOB (Italy), CySEC (Cyprus) | 1:1000 |

| #283 | City Index | FCA (United Kingdom), MAS (Singapore) | 1:30 |

| #284 | Sheer Markets | CySEC (Cyprus) | 1:100 |

| #285 | FOREXimf | BAPPEBTI (Indonesia) , ICDX (Indonesia) | 1:500 |

| #286 | Doo Prime | ASIC (Australia), FCA (United Kingdom), FINTRAC (Canada), FSA (Seychelles), FSC (Mauritius), LFSA (Malaysia), VFSC (Vanuatu) | 1:1000 |

| #287 | Finex | BAPPEBTI (Indonesia) , JFX (Indonesia) | 1:500 |

| #288 | Trading.com | FCA (United Kingdom) | 1:30 |

| #289 | KCM Trade | ASIC (Australia), FSC (Mauritius) | 1:400 |

| #290 | RoboMarkets | CySEC (Cyprus) | 1:500 |

| #291 | X Global Markets | BaFin (Germany) , CONSOB (Italy), CySEC (Cyprus), VFSC (Vanuatu) | 1:200 |

| #292 | IMS Markets | CySEC (Cyprus) | 1:30 |

| #293 | MagnetFX | BAPPEBTI (Indonesia) , ICDX (Indonesia) | 1:400 |

| #294 | Fxview | CySEC (Cyprus), FSCA (South Africa) | 1:500 |

| #295 | Magic Compass | CySEC (Cyprus) | 1:20 |

| #296 | Moneta Markets | CIMA (Cayman Islands) | 1:500 |

| #297 | Pacific Union | CySEC (Cyprus), FSA (Seychelles) | 1:1000 |

| #298 | Afterprime | FSA (Seychelles) | 1:200 |

| #299 | MACRO MARKETS | ASIC (Australia), FSA (Seychelles) | 1:500 |

| #300 | Agrodana Futures | BAPPEBTI (Indonesia) | 1:100 |

| #301 | Woxa | FSC (Mauritius) | 1:400 |

| #302 | Sôegee Futures | BAPPEBTI (Indonesia) | 1:400 |

| #303 | FXPN | NBRB (Belarus) | 1:200 |

| #304 | FXChoice | FSC (Belize) | 1:1000 |

| #305 | ForexClub | NBRB (Belarus) | 1:1000 |

| #306 | Java | BAPPEBTI (Indonesia) , ICDX (Indonesia), JFX (Indonesia) | 1:200 |

| #307 | Vatee | ASIC (Australia), VFSC (Vanuatu) | 1:500 |

| #308 | Maxain | LFSA (Malaysia) | 1:1000 |

| #309 | Asiapro | BAPPEBTI (Indonesia) , ICDX (Indonesia) | 1:500 |

| #310 | TIO Markets | FCA (United Kingdom) | 1:1000 |

| #311 | XS | ASIC (Australia), CySEC (Cyprus), FSA (Seychelles) | 1:500 |

| #312 | Handal Semesta Berjangka | BAPPEBTI (Indonesia) , ICDX (Indonesia) | 1:400 |

| #313 | Banxso | CySEC (Cyprus) | 1:600 |

| #314 | Credit Financier Invest | BDL (Lebanon), CySEC (Cyprus), DFSA (United Arab Emirates), FCA (United Kingdom), FSA (Seychelles), FSC (Mauritius), JSC (Jordan), SCA (United Arab Emirates), VFSC (Vanuatu) | 1:500 |

| #315 | Baxia Markets | FSA (Seychelles), SCB (Bahamas) | 1:2000 |

| #316 | ORBI Trade | FSA (Seychelles) | 1:1000 |

| #317 | GWG | CySEC (Cyprus) | 1:200 |

| #318 | VIBHS | FCA (United Kingdom) | 1:30 |

| #319 | Octa | BAPPEBTI (Indonesia) , ICDX (Indonesia) | 1:500 |

| #320 | FINANSERO | CySEC (Cyprus) | 1:200 |

| #321 | TRADE.COM | CNMV (Spain), CONSOB (Italy), CySEC (Cyprus), FINRA (United States), FSC (Mauritius) | 1:300 |

| #322 | Antos Pinnacles | LFSA (Malaysia) | 1:200 |

| #323 | Axiance | FSA (Seychelles) | 1:500 |

| #324 | BelFX | FSC (Belize) | 1:500 |

| #325 | One Global Market | FCA (United Kingdom) | 1:300 |

| #326 | Capitalix | FSA (Seychelles) | 1:200 |

| #327 | Excent Capital | FSA (Seychelles) | 1:100 |

| #328 | Modmount | FSA (Seychelles) | 1:400 |

| #329 | Easy Trading Online | ASIC (Australia) | 1:500 |

| #330 | CDO Markets | VFSC (Vanuatu) | 1:500 |

| #331 | ArgoTrade | FSA (Seychelles) | 1:300 |

| #332 | Evest | VFSC (Vanuatu) | 1:400 |

| #333 | Weltrade | FSCA (South Africa) | 1:1000 |

| #334 | Headway | FSCA (South Africa) | 1:1000000 |

| #335 | Gulf Brokers | FSA (Seychelles) | 1:500 |

| #336 | Direct Trading Technologies | SCA (United Arab Emirates), VFSC (Vanuatu) | 1:200 |

| #337 | Esperio | NFA (United States) | 1:1000 |

| #338 | ForexVox | FSA (Seychelles) | 1:500 |

| #339 | Nation FX | ASIC (Australia) | 1:300 |

| #340 | INZO | FSA (Seychelles), MISA (Comoros) | 1:500 |

| #341 | QRSfx | ASIC (Australia), MISA (Comoros) | 1:500 |

| #342 | Sterling Gent Trading | FSC (The British Virgin Islands) | 1:100 |

| #343 | PatronFX | CySEC (Cyprus) | 1:400 |

| #344 | Viverno | CySEC (Cyprus) | 1:30 |

| #345 | OffersFX | CySEC (Cyprus) | 1:30 |

| #346 | Swissquote | CySEC (Cyprus), DFSA (United Arab Emirates), FCA (United Kingdom), FINMA (Switzerland), MAS (Singapore), MFSA (Malta), SFC (Hong Kong) | 1:400 |

| #347 | FXlift | CySEC (Cyprus) | 1:1000 |

| #348 | Supreme FX | FSA (Seychelles) | 1:500 |

| #349 | Blue Suisse | MFSA (Malta) | 1:30 |

| #350 | Financial Trading Dimensions | FSC (The British Virgin Islands) | 1:100 |

| #351 | Klips | CySEC (Cyprus), FSCA (South Africa) | 1:30 |

| #352 | Victory International Futures | BAPPEBTI (Indonesia) , ICDX (Indonesia) | 1:100 |

| #353 | GOFX | FSA (Seychelles) | 1:3000 |

| #354 | Bold Prime | ASIC (Australia) | 1:2000 |

| #355 | Dream Begin Global Markets | ASIC (Australia), FCA (United Kingdom), FSCA (South Africa) | 1:500 |

| #356 | CA Markets | ASIC (Australia), FSPR (New Zealand), VFSC (Vanuatu) | 1:500 |

| #357 | XB Prime | FSA (Seychelles) | 1:500 |

| #358 | EPFX | ASIC (Australia), FSCA (South Africa) | 1:500 |

Brokers Requiring Additional Regulation

| Broker Name | Maximum Leverage |

|---|---|

| Olymp Trade | 1:500 |

| MBFX | 1:500 |

| Ivision Market | 1:1000 |

| Pocket Option | 1:1000 |

| Grand Capital | 1:500 |

| Fresh Forex | 1:2000 |

| WINGO | 1:400 |

| NOZAX | 1:500 |

| LYNX | 1:40 |

| ePlanet Brokers | 1:500 |

| KVB | 1:1000 |

| Finowiz | 1:500 |

| Murrentrade | 1:500 |

| STP Trading | 1:200 |

| LDN Global Markets | 1:500 |

| Orbit FX | 1:200 |

How To Choose A Good Forex Broker

Table of Contents

A good forex broker does not have to score 10/10 for all the criteria we have in this comprehensive guide. It is certainly great enough if it can cater to your overall money management and trading styles. Every trader is unique, hence each forex broker might be suitable for different traders.

Here we break down the criteria into a few crucial parts:

- Fees and Trading Cost

- Security and Regulation

- Broker Types

- Trading Platforms and Tools

- Deposit and Withdrawal

- Account Opening

- Markets and Products

- Education

- Customer Service

- Research

- Forex Promotions and Bonuses

- Supported Trading Styles

1. Fees and Trading Cost

It is crucial to keep the overall trading cost low because it is in line with the single goal of trading: generating profit. Hence, knowing how those costs actually incur is of utmost importance for savvy traders.

Forex broker imposes broker fees to its clients in exchange for the services it provides. It is also one of the ways a forex broker covers its operation costs and gains its business income.

However, forex is also known as a zero-sum game; one man’s gain is another man’s loss. Broker fees have a direct impact on the overall trader’s performance. It will influence trading profitability in the long run especially if you are constantly trading in a big volume. Naturally, broker fees become a considerable cost for you. It is hence a factor we do not want to neglect when it comes to choosing a forex broker.

In our discovery, broker fees can be segmented into 2 main categories: Trading fees and Non-Trading Fees.

Trading Fees

Trading fees happen when you trade. They can be the commissions, spreads, and swaps (weekly commission for Islamic accounts).

It can be quite tricky when it comes to commission and spread. We have seen many models of commission and spread that are available with the forex brokers. Here are some of them:

- Higher spread + zero commission

- Lower spread + fixed commission per trade

- Zero spread + variable commission based on trade volume.

Commission

Commission usually is charged whenever a trader opens a position or closes a position. It means for a complete trade (open and close), a trader will be charged twice for the commission. The commission can be either fixed or based on the trading volume.

Every broker has its own terms and conditions when it comes to commission. In most cases, there will be no commission when the main cost of the trading comes from a spread.

Spread

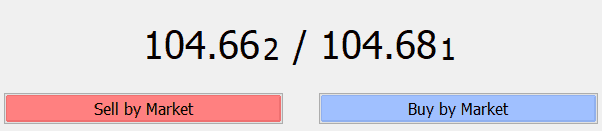

In the forex market, we always see there are 2 different prices for each currency pair. In the following example, we are looking at the price difference of USDJPY.

104.66 is the bid-price and 104.68 is the ask-price. Spread is simply the difference between the bid-price and the ask-price. In our case, the spread is 2 pips.

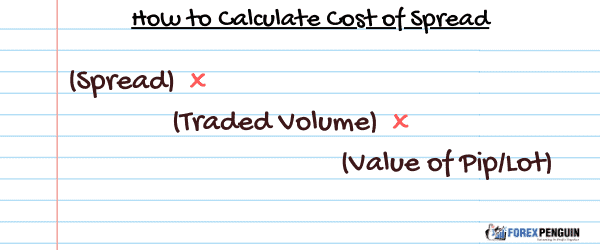

The cost of the spread is calculated in the following formula:

Spread x Traded Volume x Value of the Pip/Lot

We use the same example of USDJPY. The spread is 2 pips. Let’s say we traded 1 lot size and the value of the pip/lot is $9.

So the cost of the spread is 2 pips x $9 = $18.

Unlike commission, spread cost is only charged once per trade. It happens when the trade is opened and traders pay it when the trade is closed.

In other words, when traders open a trade with spread, the trade will have an initial loss. It is the traders’ duty to overcome the initial loss and make a profit.

Swap/Overnight Rate

Swaps are also known as the overnight rate, margin rate, financing rate, rollover rate, and funding rate.

Swap occurs when you hold an open position overnight or precisely through the cut-off time. The usual cut-off time is 5 pm ET but different brokers might have a different cut-off time. It means if you open a position at 4:21 pm ET and close it at 5:01 pm ET, a swap happens. Whatever positions that you hold through 5 pm ET are considered overnight.

When that happens, you will either be charged or paid an interest depending on the interest rates of the two currencies and the admin fees imposed by the forex broker. We call this interest a swap. There are two types of swap, namely swap long (holding a long position overnight) and swap short (holding a short position overnight).

Swap Calculation Formula

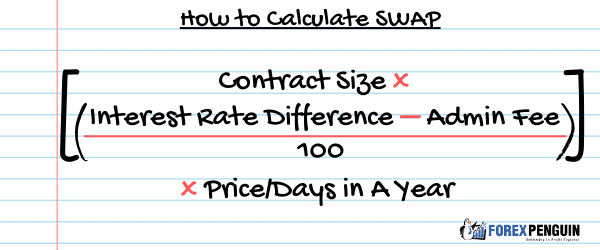

The formula of swap is as the following:

Swap = (Contract Size x (Interest Rate Difference – Admin Fee)/100) x Price/Days in A Year

Let’s look closely at the variables of this formula.

Swap Formula Variables

Contract Size: If we are trading 1 standard lot of EUR/USD, the contract size here will be 100,000 In forex, 1 standard lot is equal to 100,000 units of the base currency and it is the same for any currency pair. The base currency is the first currency that appears in the currency pair. For example, AUD/USD, the base currency is AUD. Another example, if we open 0.1 lot of GBP/USD, then our contract size is 10,000 GBP.

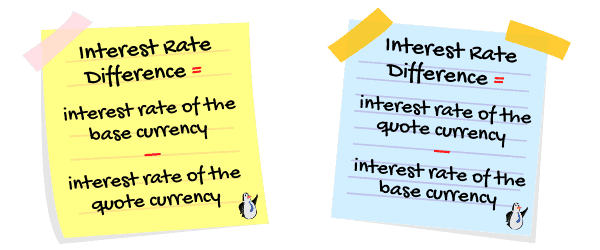

Interest Rate Difference: It is the interest rate difference between the two currencies in a currency pair. In our calculation, the interest rate difference depends on whether it is a short or long trade. For example, if we buy(long) EUR/USD, the interest rate difference = interest rate of the base currency – interest rate of the quote currency (EUR interest rate – USD interest rate). In the opposite situation, if we sell(short) EUR/USD, the interest rate difference = interest rate of the quote currency – interest rate of the base currency (USD interest rate – EUR interest rate).

Admin fee: It is also called the broker markup. In the normal case, it is a predetermined fee that the broker sets. The idea behind the admin fee is that the forex broker charges an interest rate for lending you money to trade forex. It is basically the interest rate charged on the margin loans. With the leverage offered by the forex brokers, we are trading on the borrowed money. For every borrowed money, we need to pay an overnight interest.

Price: Current price when the swap occurs.

Days in a year: 365 days or 366 days.

Sometimes, traders can even earn an overnight interest instead of paying one.

In this formula, if we get a positive swap, it means we will be paid an overnight interest. However, if the swap is negative, we will pay the interest.

Nevertheless, in the current market, positive overnight rates rarely happen.

Let’s do some calculations.

Swap Calculation Example

Example 1:

Ahmad opens a long position of GBP/USD for 1 standard lot and holds it through 5 pm ET.

The current interest rate of the Bank of England (UK) is 0.10% and the Federal Reserve (US) is 0.25%.

By longing GBP/USD, Ahmad is buying 100,000 GBP (base currency) and earn interest at the rate of 0.10%. At the same time, he is also selling USD (the quote currency), borrowing at a rate of 0.25%. The admin fee of the forex broker is 0.25%.

The current price of the GBP/USD when the swap occurs is 1.2500.

From the swap formula above, we need to find out what are the variables involved.

- Contract Size: 100,000 GBP (1 standard lot)

- Interest Rate Difference: Interest rate of base currency – interest rate of quote currency. 0.1% – 0.25% = -0.15%

- Admin Fee: 0.25%

- Price: 1.2500

- Days in a year: 365

So, his swap long will be as the following:

Swap Long = (100,000 x (-0.15 – 0.25)/100)) x 1.2500 / 365 = -1.37 USD

If he shorts the position instead, the swap short is as the following:

Swap Short = (100,000 x ((0.25 – 0.10) – 0.25)/100) x 1.2500 / 365 = -0.34 USD

In both calculations, we have a negative swap. This indicates that Ahmad will have to pay the interest for both instances (long or short).

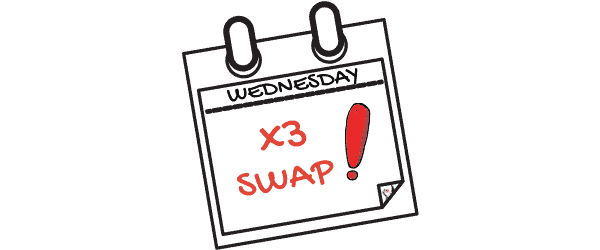

Triple Swap Wednesday

There is one more thing that we should be aware of: the triple swap Wednesday (also known as weekend swap). For every trade that is carried over from Wednesday to Thursday, it is counted as 3 nights swap interest. It is an industry-standard because of the T+2 settlement. In our example of Ahmad, if he opens a long position on Wednesday and lets it roll over to Thursday, then he would have paid 1.37 USD x 3 = 4.11 USD.

Swap is often an overlooked fee in forex trading. The cost might not occur if you are a day trader or a scalper. However, for swing traders and position traders, the swap is not something that can be neglected.

Swap Free Islamic Account

In recent years, forex brokers have created a new type of forex account that we call “Swap-Free Account” or “Islamic Account”. As the name suggests, this type of account does not have a swap element in it. The existence of this kind of account is due to the fact that Sharia laws (Islamic laws) prohibit Muslims from taking or giving any sort of interest.

In general, nobody is able to check your religious faith. That means anyone can open an Islamic account. Depending on the brokers, Islamic accounts might only be available for certain countries.

Islamic account holders may enjoy the swap-free trading environment with certain restrictions such as lower leverage, higher minimum deposit requirement, fees for holding the trading position over a certain period of time.

Nevertheless, some brokers might even charge a weekly commission for the Islamic account. In most cases before applying for a swap-free account, it is wise to consult the forex broker for the terms and conditions for this type of forex account.

Trading Fees Recap

So far we know that trading fees occur when we trade and there are 3 things that matter in the trading fees: commission, spread, and swap. Before signing up for any broker, we should find out the trading fees and factor them into our trading cost.

Conclusion: As a rule of thumb, the brokers that offer zero commission, low spread, and swap-free accounts are more preferable.

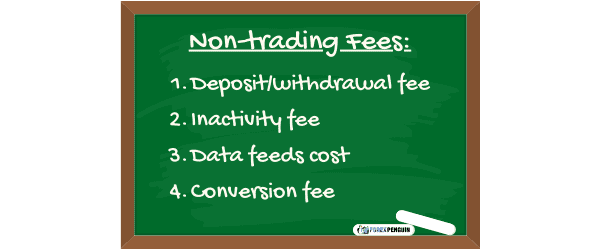

Non-Trading Fees

Non-trading fees are related to the trading account such as deposit/withdrawal fees, inactivity fees, data feeds cost and conversion fees. These fees should not be ignored because they are significant in the long run. It impacts the profitability of your trading.

Since some of these costs are inevitable, it is good to know what is in play here.

Deposit/Withdrawal Fees

Funding a trading account is not without cost. The forex brokers sometimes will charge certain fees to cover the costs incurred with the deposit. Likewise, withdrawal has its own cost as well. The costs appear because of the transaction fees by the payment processors such as banks and digital wallets.

From our experience, normally a forex broker will absorb the deposit fees in order to encourage the traders to deposit. Similarly, a forex broker might charge some withdrawal fees to discourage the withdrawal.

Inactivity Fees

Inactivity refers to the dormant account. Some brokers might charge their clients when they are inactive for a certain period of time. Although it is not very uncommon, forex brokers could use these fees to encourage their clients to remain active.

Before committing to any broker, it is better to check with the broker whether it has such a practice.

Data Feeds Costs

Data feeds help traders to see what is going on in the market. Basically, it gives the winning edge to the traders. It is normally charged monthly and the cost can be very different depending on the quality of the feeds.

It is up to traders whether they need the data feeds to help in their trading decision.

Conversion Fees

In some cases, the base account currency is different from the funding source. Let’s say we have opened a USD base account with a forex broker but our funding source is from a European bank, which transferred the money in EUR. In such a case, the forex broker will convert the EUR it received into USD. This is where the conversion fees occur.

On other hand, when we want to withdraw our money from the USD base account back to our European bank, the USD will be converted to EUR before the withdrawal can take place. Again, we have to pay the conversion fees.

Non-Trading Fees Recap

As we discussed above, non-trading fees can contribute significantly to the cost of trading. There are many forex brokers that offer zero deposit commission, low withdrawal fees, and no inactivity fees.

For the data feeds cost, it is really up to you whether it is worth your money. If the data is helping you to make a better trading decision, then it is good to subscribe to it.

As for the conversion fees, it is recommended that you make sure the base account currency is the same as our funding currency to avoid the conversion fees.

Conclusion: Non-trading fees are not negligible and with simple research, you can find the forex brokers that are offering competitive non-trading fees.

2. Security and Regulation

Should you choose a regulated forex broker? The simple answer is yes. A regulated broker can provide a better protection shield to the traders’ money. In this section, we will look into the following details:

- The reasons for forex regulation

- The tasks of the forex regulators

- The main forex regulators in different countries

The Reasons for Forex Regulation

As of the time of writing, the forex market has a daily turnover of 6.6 trillion dollars. With such an enormous amount of money involved, it attracts a lot of scammers and white-collar criminals. These fraudsters’ sole purpose is to cart away traders’ money by illegal means. They hide behind the face of the forex brokers and make a profit by scamming the traders.

Without the right regulation, the wrongdoing of the forex brokers will just go unpunished. The common frauds and unethical practices of the forex brokers are the following:

- Ponzi schemes that promise unrealistic returns

- Churning of traders’ accounts to generate commission

- Selling of illegal software that promises great profits

- Lack of transparency in the cost of trading

- Customer complaints go unheeded

- Unethical solicitation targeting vulnerable groups such as the elderly, uneducated, and low-income individuals

- Trading against the clients

- Offering unlicensed managed accounts

- Manipulation of market pricing

- Providing high leverage trading that usually results in the loss of fund

- Practicing stop hunting

- Suggesting improper trading methods to clients.

- Giving incorrect information or misleading statements.

- Providing incentives or disincentives to encourage fund deposits and discourage fund withdrawals.

The list goes on and on. These are only some of the infamous common practices by the unregulated brokers.

Hence, the regulators are important to ensure fair play in the forex industry.

The Tasks of the Forex Regulators

In essence, the main goal of the forex regulators is to provide the check and balance in the forex market. Their tasks are the following:

- Providing financial licensing to the qualified brokers

- Monitoring the compliance of the forex brokers

- Enforcing penalty to the wrong-doing brokers

Financial Licensing

Before getting a regulated status, a forex broker needs to fulfill certain criteria set by the regulatory body. Here are some of the common requirements:

- Maximum leverage allowed

- Segregated client funds

- Negative balance protection

- Restriction of incentives

- Minimum operating capital

- Client compensation fund

- Periodical financial audit report

- Minimum initial share capital

- Restriction of hedging for traders

- A local representative office

- Fair customer conduct

There are many more terms and conditions set by the regulators. However, regulators in different parts of the world are not created equally. Every regulator has its own different rules and requirements.

Upon the fulfillment of the criteria, a financial license will be issued by the particular regulator.

Compliances Monitoring

From time to time, the regulated forex brokers are required to submit their 3rd party audited financial report to the regulator. Besides that, the trading data of their clients are subject to monitoring as well. This is to ensure the forex brokers adhere strictly to the standard set by the financial watchdogs.

Some regulators, ASIC for example, releases enforcement update every 6 months to inform the public about what they have done in the last 6 months. These reports are accessible to the public via their website.

Penalty Enforcement

If any of the regulated brokers do not comply with the rules and regulations, their regulators can take action against these brokers. Some of the known penalties are as the following:

- Reparation to the victims

- Warning

- License Suspended

- License Revoked

- Blacklisted

- Company dissolution

- Website is taken down

- Asset frozen

- Fined

- Sanction

- Banned from all investing activities

- Civil penalties

With the strong enforcement of the penalty, the regulated brokers are far safer to choose.

Conclusion: It is a recommended practice to choose a regulated broker before you decide to put your money on the line.

3. Broker Types

We have discussed the costs associated with trading forex, and gone over what you need to know about security and regulation. Now, let’s talk about the different types of forex brokers.

Forex brokers can be split into two categories. These are dealing desk brokers and no dealing desk brokers. Let’s talk about each in turn.

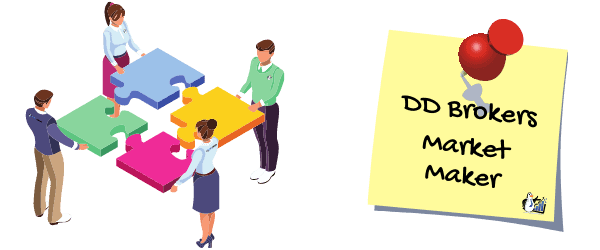

What are Dealing Desk Brokers?

Dealing desk brokers are also known as “market makers.” You will sometimes see “dealing desk” abbreviated simply as “DD.”

What distinguishes a dealing desk broker from a no dealing desk broker is that a DD broker takes the opposing side of your trade when necessary.

Indeed, by doing so, they make a market where there was not one before, thus why we call them “market makers.”

How do Dealing Desk Brokers work?

Here is what takes place behind the scenes when you place a trade with a dealing desk broker:

- You place an order to buy or sell a currency pair or other asset.

- If there is another client available placing the opposite order, you can be matched with each other. That client will take the other side of your trade.

- If the broker cannot find a match with another client, they can turn to a liquidity provider to take the other end of your trade.

- If they cannot get a liquidity provider to take the other side of your trade, they ensure you can trade anyway by trading against you themselves.

Hypothetically, that is possible, but it is unlikely to be an issue if you are dealing with a reputable site that manages its own risk effectively.

A solid DD broker has you trading against other clients and independent liquidity providers as much as possible.

That means they are not usually trading against their clients. So, even if their clients typically win, the broker does not typically lose as a result.

DD brokers offer fixed spreads for trades. That is how they profit regardless of whether their clients win or lose.

DD brokers are not “better” or “worse” than no dealing desk brokers. You will need to choose which type to use based on your needs and priorities. But knowing their basic pros and cons may help.

Pros of DD brokers:

- There will always be someone available to take the other end of your trade. Even if a matching client cannot be found, the dealing desk broker will use a liquidity provider or take the other end of the trade.

- Spreads are fixed. If you trade a lot during volatile times, working with a broker that maintains fixed spreads could feasibly save you a lot of money.

- Even though the rates you see listed by your DD broker are not the interbank market rates, they should be equivalent or nearly so.

Cons of DD brokers:

- Sometimes there may be more of a delay than you would get through a no dealing desk broker. Why? DD brokers manually fill orders. That means when a lot of orders are coming in, it can take more time for the broker to fill them all. So, that is a drawback during volatile times.

Summary: Dealing desk brokers, or “market makers,” offer fixed spreads and will take the opposing side of a trade if they are unable to find a match with another client or an independent liquidity provider.

What are No Dealing Desk Brokers?

Dealing desk brokers can be contrasted with no dealing desk (NDD) brokers. There are two types of no dealing desk brokers: straight-through processing (STP) and electronic communication network (ECN).

Don’t worry. This sounds complicated, but it really isn’t. We will break it down for you below.

As we explained previously, a dealing desk broker is one that sometimes takes the other side of client orders.

By contrast, no dealing desk brokers do not do that. All they do is connect you to a client or company that is taking the opposing side of your trade.

That could be another individual retail trader like you, or it might be a broker, hedge fund, bank, or mutual fund.

STP Brokers

If you go with an NDD STP broker, the broker will check quotes from a number of different liquidity providers in order to find the most competitive price for you.

The broker will then route your order to that provider, charging you a small markup for the legwork involved in finding you the best price.

Take note that you will not see the list with all the different prices in it.

Owing to the fact that the spreads of the broker are dependent on the spreads of the liquidity providers, they are variable in nature, which is a major difference from a regular dealing desk broker.

Note that while you will usually see STP brokers referred to as no dealing desk brokers, they do sometimes take the opposite side of trades.

Unlike regular dealing desk brokers though, they do not manually fill orders. They use an automatic system for it.

That is why they are called “straight-through processing” brokers.

Because they may combine aspects of the dealing desk and no dealing desk models, they might be more accurately considered to be a cross between the two, rather than strictly a type of NDD broker.

Pros of STP Brokers:

- While there is a small markup fee, there are no commissions on trades.

- The STP broker does the work for you of searching for the most competitive price at which to fill your order.

- Because orders are filled automatically, not manually, there are fewer delays.

- Spreads may be variable (but sometimes you will see fixed spreads too). This may be a plus for you if you do a lot of trading during times with lower volatility. Otherwise, it might be a drawback.

Cons of STP Brokers:

- STP brokers are not considered quite as transparent as ECN brokers, who may also have more competitive spreads.

- Variable spreads may be a disadvantage if you are a high-volatility trader.

Summary: An STP broker is classified as a no dealing desk broker, but combines aspects of DD and NDD brokers. They offer fast, automatic execution and both variable and fixed spreads. You will have to pay a small markup on your trades.

ECN Brokers

So, now you know what an STP broker is. But what is an ECN broker?

This type of NDD broker is one that matches you with liquidity providers, banks, other brokers, and other institutions.

But unlike with a regular STP broker, this type of broker displays full transparent price information.

As with STP brokers, ECN brokers fill orders automatically, not manually, for rapid execution.

ECN brokers do not trade against their clients. They simply serve as a bridge between parties.

Pros of ECN brokers:

- As with STP brokers, ECN brokers offer variable spreads. While this may be a drawback during times of high volatility, if you trade a lot during low volatility times, you might save money over fixed spreads.

- The ECN fills orders automatically rather than manually, allowing for fast execution.

- The wide range of ECN participants allows for competitive pricing and spreads.

- With ECN trading, the broker never trades against you. If you have concerns about conflicts of interest with other types of brokers, you may feel more secure trading with an ECN broker.

- ECN trading is always open, 24/7.

- You can see Depth of Market (DOM) with this type of broker. What is the Depth of Market? It is the same thing as an Order Book. It displays all the orders at various prices. That level of transparency is the highest you will find.

Cons of ECN brokers:

- An ECN broker operates with higher overhead than other types of forex brokers. So, on top of the spread, you will need to pay a commission on each of your trades. The commission will be fixed.

- You might not be able to trade with this type of broker with small account size. The minimum deposit required tends to exceed that for other types of brokers.

- There might be times you cannot trade because no one is available to trade against you. Needless to say, this can be very frustrating if you miss out on a great opportunity.

Summary: ECN brokers are NDD brokers that never trade against their clients. They fill orders automatically with variable spreads and display Depth of Market for superior transparency. They do charge commissions.

Which Broker Types to choose?

So, with respect to all the pros and cons we have talked about, here are some questions you should ask yourself when you are deciding what type of forex broker to use:

- How much money do I have to deposit? How large an account am I ready to trade with?

- During what hours do I want to be able to trade?

- How important is transparency to me? Do I want to be able to view Depth of Market?

- Will I be doing a lot of trading during high volatility times? What is most important to me, fixed spreads or fast execution?

- What am I comfortable paying in terms of spreads, markups, and commissions?

- Is it important to me that my broker never take the opposing side of my trades?

Based on your answers to these questions, you can choose the type of forex broker that is right for you.

Remember, you can also sign up with more than one FX broker. That way, you have more options and flexibility. One broker might serve you better during high volatility times, and another during low volatility times. Read on to the next section to learn about trading platforms and tools.

4. Trading Platforms and Tools

We’ve just discussed the different types of forex brokers you might encounter. Now let’s talk about trading platforms and tools.

What is a Forex Trading Platform?

A forex trading platform is a software program you can use to place trades.

Sometimes novice investors confuse trading platforms and brokers. As we have discussed, a broker is an entity that facilitates your trades.

But the platform is the actual software you interact with when you place your orders.

Some brokers offer proprietary trading platforms. But most also allow you to trade through open platforms. These are platforms that many different brokers use.

In some cases, you might decide to use one of these open platforms for trading even if there is also a proprietary platform offered by your broker.

It all comes down to what features you need.

What Should You Look For in a Quality Forex Trading Platform?

Here are some features that are important in a high-quality forex trading platform:

- Compatibility. The platform you choose must be compatible with your operating system and device as well as your broker.

- Trade Execution: A good trading platform should execute your orders rapidly with minimal slippage. A variety of different types of orders should be available. The ability to set alerts may also be important, depending on your system.

- Analytical Tools: Trading platforms may offer analytical tools that help you monitor your progress. Analytical tools may also refer to indicators and drawing tools (see below).

- Charting: Choose a platform that allows you to chart the currency pairs you want and the timeframes you need. Indicators and drawing tools can help you to establish context and identify setups that fit within your trading methods. Some platforms even let you load in custom indicators. For backtesting purposes, also look for platforms that let you scroll back through significant historical data so you can test your system over a longer time period.

- Expert Advisor/Robot Trading: Want to automate aspects of your forex trading? Pick a platform that lets you use the expert advisors or robots of your choice.

- Forex News: A quality trading platform may include a dedicated news feed to help you trade.

- Community: Social trading features allow you to collaborate with other investors for success.

Please note that these are just a few of the most important features to consider when evaluating different trading platforms.

Depending on your specific strategies, there may be other features that are imperative for your needs.

Top Recommended Forex Trading Platforms

Now that you know some of the key features to look for when comparing trading platforms, let’s go ahead and discuss some of the most prominent open trading platforms for forex.

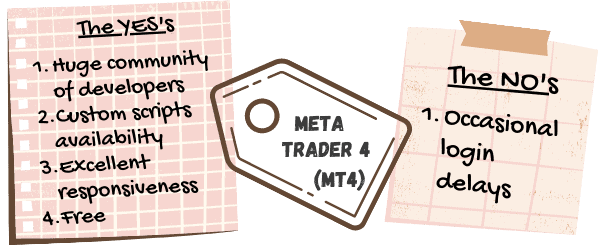

MetaTrader 4

If there is one third-party forex trading platform that you have heard of, it is probably MetaTrader 4 (MT4). This platform from MetaQuotes Software has been around since 2005, making it one of the first big open platforms for FX traders.

The software is compatible with Android and iOS smartphones as well as Windows, Mac OS, and Linux desktop and laptop systems. You can download the program or trade on your browser.

- Trade Execution: MT4 has a solid reputation for fast trade execution.

- Analytical Tools and charting: MT4 charts are highly customizable to your needs for a wide range of currency pairs. Numerous indicators are available, and you can load in custom indicators too.

- Expert Advisor/Robot Trading: You can both use Expert Advisors and create your own.

- Forex News: Articles are available through the MT4 community.

- Community: There is a dedicated community for MT4 which gives you access to news, a forum, signals, jobs, and more.

Advantages

A massive community of developers, a huge library of custom scripts, and excellent responsiveness all combine to make this one of the best trading platforms out there. Oh, and did we mention it won’t cost you a dime?

Disadvantages

It is hard to name a lot of drawbacks for MT4, but sometimes there can be delays while trying to log in.

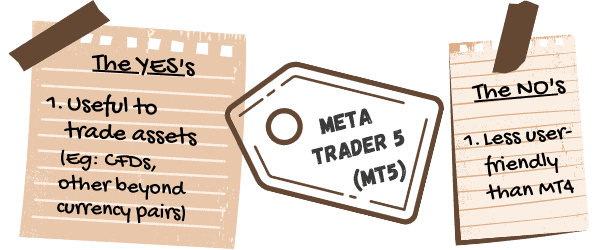

MetaTrader 5

The follow-up to MetaTrader 4 is MetaTrader 5, which came out in 2010. Normally with software, the newest version of a program is the one most people use, but that never happened with MT5. The majority of brokers stuck with MetaTrader 4, and most traders continue to use MT4 as well a decade later.

The main reason for this is that MT5 simply has a different focus than MT4. MetaTrader 4 was built for FX specifically. MT5, on the other hand, features futures, stocks, and other assets.

- Trade Execution: Naturally, MetaTrader 5 features rapid execution just as MetaTrader 4 does.

- Analytical Tools and charting: Charting is similar for both programs, but there are 21 timeframes on MT5 versus the 9 timeframes on MT4. There are a few more built-in indicators in MT5 as well, but as you can use thousands of indicators in either program, this isn’t a big difference. If you are going to be doing any programming, you may actually find the MQL4 language for MT4 easier to grasp than the MQL5 language for MT5.

- Expert Advisor/Robot Trading: Like MT4, MT5 supports a huge range of Expert Advisors.

- Forex News: MT5 features a built-in Economic Calendar.

- Community: Like MT4, MT5 has an active community dedicated to signals, articles, and more.

Advantages

MetaTrader 5 may be ideal if you are wanting to trade assets such as CFDs and others beyond currency pairs.

Disadvantages

MT5 is not as user-friendly as MT4, which is why many people don’t get into using it unless they need it to trade other assets. It makes more sense for the majority of forex traders to stick with MT4.

cTrader

The same year that MT5 came out, cTrader showed up from a company called Spotware. It is compatible with Windows operating systems as far back as Windows 7 as well as Android and iOS systems. There also is a web version.

- Trade Execution: Trades execute quickly and reliably through cTrader.

- Analytical Tools and charting: cTrader Analyze can help you examine your performance. Custom indicators are available in the desktop version of cTrader.

- Expert Advisor/Robot Trading: You can automate trading using cBots through cTrader Automate. The code editor also allows you to develop custom cBots and indicators yourself.

- Forex News: It is possible to integrate the FXStreet economic calendar.

- Community: Community resources and support for cTrader are minimal compared to what is available for MT4 and MT5.

Advantages

cTrader stands out with respect to ease-of-use, even compared to MT4. Also, it has come a long way since its original introduction and has many more features than it boasted when it was new.

Disadvantages

Even though auto-trading and custom indicators are supported by cTrader, the selection is much larger through MT4, and the support is more substantial.

NinjaTrader

Another of the oldest third-party trading platforms for forex is NinjaTrader. Since 2004, investors have been using this software for not just forex trading, but also for other assets like futures and stocks. Unlike some other platforms, NinjaTrader relies on other providers for market data rather than functioning as a provider itself.

- Trade Execution: This platform has a longstanding reputation for fast and reliable execution of trades.

- Analytical Tools and charting: There are thousands of indicators and apps available for NinjaTrader.

- Expert Advisor/Robot Trading: You can use more than a hundred automated strategies with this platform.

- Forex News: NinjaTrader maintains an active blog with economic news.

- Community: There is a social trading network for investors using this platform as well as a support forum.

Advantages

This broker is renowned for its lightning-fast trade execution. And while it is not as big a platform as MT4, it has a dedicated community of loyal users and a solid reputation.

Disadvantages

Only the basic version of this platform is free. If you want to be able to conduct backtesting, use custom indicators, or take advantage of other advanced features, you need to upgrade to paid access. At the time of this writing, that is $60 a month. If you prefer, you can pay a one-time fee of $1,099. Contrast that with the advanced features you get for free with MT4.

eSignal

- Trade Execution: Like the other top platforms we are featuring here, eSignal offers rapid and reliable execution of orders.

- Analytical Tools and charting: You can view as many as 500 symbols simultaneously and use hundreds of indicators through the App Store. There are advanced drawing tools as well as customizable studies.

- Expert Advisor/Robot Trading: Automated trading is supported by eSignal.

- Forex News: News, commentary, and research are available at the top two tiers of membership.

- Community: eSignal provides community features such as a knowledgebase, forums, and file sharing.

Advantages

eSignal takes pride in offering a huge range of trading instruments including currency pairs, indices, stocks, ETFs, and more. In terms of advanced tools and customization, they are an excellent option all around.

Disadvantages

This is another paid trading platform following a 30-day risk-free trial. There are three plans: Classic, Signature, and Elite. The Classic plan is $56 per month, while the Elite plan runs $378 per month. Some features like advanced GET technical analysis are only available at the highest tier.

ProRealTime

ProRealTime is a trading platform for forex and a variety of other instruments. There is a version you can download and install, or you can access it online through your browser on your laptop, desktop, or mobile device.

- Trade Execution: Trades execute quickly and reliably on ProRealTime.

- Analytical Tools and charting: There are well over a hundred built-in indicators and drawing tools for your charts. You also can use the code editor that comes with the program if you want to create custom indicators. You get access to more tools if you go with a premium subscription.

- Expert Advisor/Robot Trading: You can use the ProOrder automatic trading module.

- Forex News: News is built right into the platform, and if you get the Premium version, you can view up to 400 days of archived news.

- Community: The ProCommunity lets you follow the progress of traders on the platform. You can also use it if you want to manage your own network of traders.

Advantages

There are a lot of powerful features for ProRealTime, especially if you purchase a subscription.

Disadvantages

While there is a free End-of-Day version of ProRealTime, if you want real-time and intraday data, you need to pay for a subscription. As of the time of this writing, subscriptions start at $37.45 per month. That is a solid value for a high-quality platform with excellent features.

Overall Best Forex Trading Platform: MetaTrader 4

You have had a chance to compare the features, pros, and cons of some of the most popular trading platforms available.

While cTrader has come a long way, it still cannot compete with MT4 or MT5.

ProRealTime, eSignal, and NinjaTrader are all-powerful options, but they do require a subscription to access many of their advanced features. That is not the case with MT4. While you can pay for Expert Advisors and indicators for MT4, you do not need to pay for the platform itself.

Meanwhile, MT5 is a nice option if you want to trade instruments beyond currency pairs, but doesn’t add much to recommend it above MT4 otherwise.

For ease-of-use, advanced features, and extensive custom indicators, robots, and community support, it is hard to beat MetaTrader 4. There is a reason that this is the platform of choice for so many brokers and traders even after all this time.

Now you are familiar with some of the top forex trading platforms out there, and you have our overall top recommendation of MetaTrader 4. Let’s move on to talk about what you need to know about making forex deposits and withdrawals.

5. Deposit and Withdrawal

Another key consideration when choosing a forex broker is how you will move money in and out of your trading account.

Different brokers accept different methods for depositing and withdrawing funds, and also have different fees, limits and processing speeds to consider. Let’s break these factors down so you know what to look at when you are evaluating potential brokers.

Deposit and Withdrawal Methods

How do you deposit and withdraw money from your account? For your convenience, most FX brokers accept a range of different deposit and withdrawal methods. Below are some of the most common methods for adding and removing funds. Keep in mind that not every site accepts every method. Some sites may also accept methods not listed here.

- Credit or debit card. Most websites accept most major credit cards. This method offers a fast, easy, and convenient way to make a transfer.

- Bank wire transfer. It takes several days to transfer money this way, and you will usually pay a service fee. The bank charges you this, not the broker.

- Check. You can write an old-fashioned check to make a deposit into your account. This method also takes a few days to process.

- Automated clearing house (ACH). While this method can take a number of days to process, it is a secure method that can work well for large and small transfers.

- Digital wallet. You may be able to transfer money on some sites using a digital wallet service such as PayPal or Neteller.

- Cryptocurrency. You may be able to deposit and withdraw to a bitcoin wallet or another crypto wallet.

We recommend brokers that offer many methods for transfers. For example, FreshForex accepts 20 different methods.

Deposit and Withdrawal Fees

Fees may be charged on deposits or withdrawals by the broker or your bank, depending on the method you choose. For example, if you make a wire transfer, your bank will generally charge you a fee of around $25-$35.

Usually, with credit or debit card transfers, there will be no fees. But there are exceptions.

It is important to check whether a broker will be charging you fees for transfers, and if so, what they are.

That way, you can avoid brokers that are eating unnecessarily into your profits through excessive fees.

Deposit and Withdrawal Limits

For any given deposit or withdrawal method on each forex site, there may be a minimum or maximum limit to what you can transfer.

Here are a couple of examples as of the time of this writing:

- The minimum deposit on AGEA is just $1.

- The minimum deposit/withdrawal amount on VantageFX is $200 for a retail account.

- On RoboForex, the limits of the deposit for a bank transfer are €500–€100,000. The withdrawal limits are €500-€50,000. For most electronic wallets, there is a deposit limit of €10-€10,000.

- On XM, there is a minimum withdrawal of $5 using a local bank transfer and no maximum.

- On Oanda, you cannot withdraw more using a debit card than you deposited using the same card. You can only deposit up to $20,000 a month using this method.

Again, those are just a few examples. You need to look up the minimum and maximum amounts for the transfer method of your choice on the site you are thinking of trading with to know what to expect.

Deposit and Withdrawal Processing Speeds

Another way in which deposits and withdrawals can vary from broker to broker is with respect to how fast transfer requests are processed.

As we mentioned before, some payment methods are faster or slower than others. But for a single payment method, you might see differences from one site to another as well.

For example, one broker might process debit card transfers within one business day, while another might do so within 1-3 business days.

Obviously, faster is better for transfers. But even with slower transfer speeds, you can typically plan ahead and schedule your deposits and withdrawals in a way that works for you.

Questions to Ask When Researching Deposit and Withdrawal Methods Offered by Forex Brokers

We recommend that if you are considering signing up to trade with a broker, you ask yourself the following questions regarding transfers:

- What transfer method do I want to use for deposits?

- What transfer method do I want to use for withdrawals?

- On this site, if I want to make a withdrawal using method X, do I also need to use method X to make my deposit? Will that work for me?

- Is the processing time for the transfer method I want to use sufficient for me for both deposits and withdrawals?

- Are there fees for deposit? What about withdrawal? Are they reasonable?

- What is the minimum deposit amount? Can I afford it?

- How much can I withdraw at one time using the method of my choice? Will that ceiling be appropriate for me?

It should be fast, affordable, and convenient for you to transfer money to or from your forex account.

If you are satisfied with the methods and policies at the site you are thinking of joining, it may be a good fit for you.

Now you know more about making deposits and withdrawals on forex websites. Read on to the next section to learn what you need to know about opening an account on a forex website.

6. Account Opening

We have talked about different types of deposit and withdrawal methods for trading forex. But before you can deposit money into an FX account, you first need to open one. So, how do you do that?

The exact process of opening an account depends on the specific broker you are using. In this section, we will go over the basic steps you can expect when registering to trade at most sites.

Criteria of Account Opening

As we review each step, we will talk about some relevant considerations that may impact your choice of a broker. These include:

- Overall speed and ease of account opening

- Documentation required

- Types of accounts

- Approval speed

- Minimum funds to open an account

- Available base currencies

- Maximum leverage available

- Languages available

- Regions accepted

Questions about Account Opening

You can find out about a lot of these differences between brokers before you ever start the account opening process. So, we recommend checking the FAQs of brokers you are considering before you start the account setup process.

You also can check forex forums and social media sites to view real feedback from customers about the ease of the account opening process and the speed of verification.

Ask yourself the following questions while conducting your research:

- What is your preferred way to submit identity verification documents?

- How much do you want to deposit to start with?

- What lot size do you want to trade?

- Do you need a special type of account, like an Islamic account?

- What base currency do you want for your account?

- Are you in a region where not all brokers are likely to accept you?

- How soon do you want to start trading? How fast do you want approval to be?

Based on your answers to those questions, you can choose a broker that will allow you to open an account that fits your requirements and hopefully will encounter no surprises along the way.

Now, let’s go over the process of opening a forex account, noting where you may encounter divergences between different trading sites.

How to Open an Account with a Forex Broker

Click on “Register.”

To get started on any forex site, you will click on a button to open an account. It might say “Register” or “Sign Up” or “Open an Account” or something similar.

Provide your basic information.

The next step will usually be to provide your basic information to open an account. That means your email address and choosing a password, at the minimum. You might be asked for some other basic information as well.

At this point, you typically will have to check a box saying that you agree to the terms and conditions.

Check your email.

Usually, you will either be sent a pin number that you will need to type in to confirm your email address, or you will receive an auto-generated password in your inbox if you were not asked to enter a password when you registered.

Check your email for the information you need, and enter it on the page where you are asked to do so.

Log in.

If the site does not automatically log you in, log in manually.

Create a trading account.

Once you are logged in, you will need to open an account to use for trading. There may be several types of accounts available, depending on the broker. Some options might include:

- Real account

- Demo account

- Islamic account

Select the type of account you want. Choose your preferred leverage and currency, and answer any other questions you are asked.

Don’t see the type of account you want? You may need to choose another broker.

Likewise, if you require more leverage than a particular broker offers, you will need to pick one that offers higher maximum leverage.

Most major FX sites will accept major currencies like USD, EUR, and GBP.

If your preferred currency is unavailable, that does not mean you cannot trade on a site. It just means you will need to convert your funds into one of the acceptable currencies when making a deposit.

Note that real accounts fall into the following categories:

- Standard

- Mini

- Micro

Each of these types of accounts has a different lot size.

- Micro lot = 1,000 units of your account currency

- Mini lot = 10,000 units of your account currency

- Standard lot = 100,000 units of your account currency

You need to choose a lot size and corresponding account type that is appropriate for your money management plan. The larger the lot size, the higher the risk.

If a broker does not offer the lot size you need, once more, you will need to look elsewhere.

Agree to further terms and conditions as required. Once you have filled in all the details requested, you should receive an account number and a password for that specific account.

Provide detailed profile information.

The site will now ask you for some more details. For example, you will need to provide your real phone number and address. It is important to make sure this information is accurate, or you could lose your account later.

Indeed, if a particular broker does not accept customers from your region, you should choose one that does.

Otherwise, you will not be able to complete the identity verification process.

You also will need to answer questions about your employment status and your financial situation. Responsible forex sites want to encourage only those with the means to trade forex to do so. You also may need to answer questions about your experience with FX.

Some sites ask more questions than others, but it should only take you a few minutes to answer them all in any case.

In fact, the entire account opening process up to this point should take you around 10 minutes on the majority of sites.

Submit your documents.

Before you can deposit or withdraw money from a trading account, the site needs to know that you are who you claim to be. This is a policy called “Know Your Customer,” or “KYC.” So, you will need to submit your proof of identity and proof of residence at this stage.