Basic Details Of The Setup

A beautiful inside day is spotted on 28th August 2019.

Click on the image below to see the bigger version.

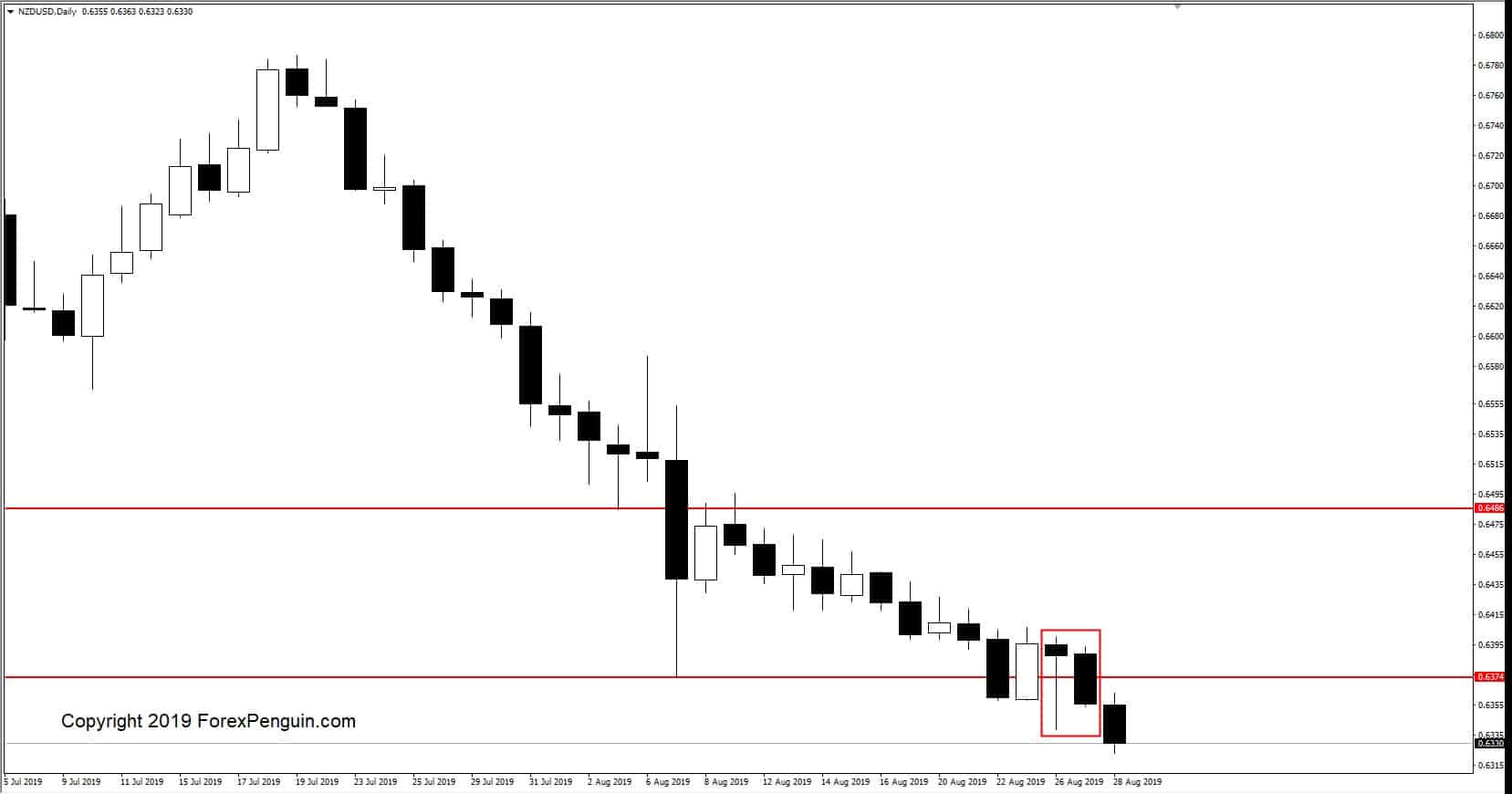

NZD/USD was in a very bearish trend since July 19. Before this inside bar, we saw a series of 10 inside bars which indicated that the market was not knowing what it was doing although the trend remained slightly bearish. Our inside bar appeared at the breakout of the previous mother bar. It showed that finally, the bearish trend resumed.

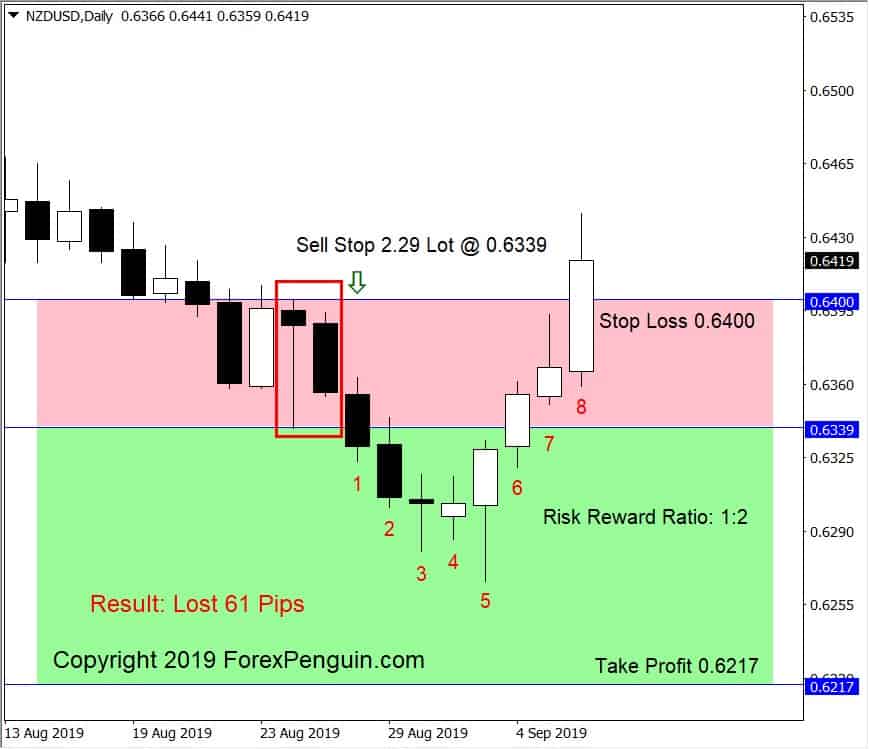

The mother bar’s prices:

High: 0.6400

Low: 0.6339

Range difference: 0.6400-0.6339 = 61 pips

It is a good range for NZD/USD since this pair does not move much daily.

Good to point out as well is that the last support at that area happened in Jan 2016. It means NZD/USD is having a decision to make. It is oversold.

So I made 2 pending orders since the inside bar appeared at the breakout of an 8 days consolidation, and also at a support line of Jan 2016.

Calculation

I have chosen 61 pips as my stop loss and $140 in the dollar value. It means the lot size that I need is $140/61pips.

This brings me the value of 2.29 lot. And the risk-reward ratio is 1:2. The profit I am looking at is 122 pips.

The pending orders are:

Buy Stop 2.29 Lot @ 0.6400, SL: 0.6339, TP: 0.6522

Sell Stop 2.29 Lot @ 0.6339, SL: 0.6400, TP: 0.6217

Progress Of The Orders

Day 1: 28th August 2019

The inside bar is spotted. 2 pending orders are opened. The sell stop order was immediately triggered. I have closed the buy stop order to prevent the order to be opened. The price closed below my position which means I was in a positive position.

Day 2: 29th August 2019

Another bearish day. The trend continues to remain very bearish. It was nice to see how this position was performing. I am one step nearer to the target. It was a good day.

Day 3: 30th August 2019

Indecision happened. A little pin bar war formed. The overall trend was still in the sellers’ favor.

Day 4: 2nd September 2019

As usual, there was nothing much happening on a Monday. It formed an inside bar. The mother bar is 37 pips long. If I was not already in the position, I wouldn’t trade it anyway. It was far too small. A standard mother bar size should be at least 50 pips. The reason behind it is that we will not have enough room to let the trade play if the stop loss is too small.

Day 5: 3rd September 2019

Because of the indecision of the previous day, the market has moved upward strongly. If anyone was playing the inside bar of the day before, it would end up in a loss. The price closed high and took all the profit with it. It seemed that a trend reversal could happen. Hopefully, this is just temporary.

Day 6: 4th September 2019

This pair had no intention to stop its bullish move. It closed again high and this time my position was in the losing position for the first time. It was not nice.

Day 7: 5th September 2019

No slow down from the trend. I was pretty sure that I will have a losing trade this time. The bearish trend has been reversed. The buyers are in control of the market now.

Day 8: 6th September 2019

Finally, I am stopped by a super bullish candlestick. I can’t believe that this trade ended in a loss. It was so promising. Anyway, it was a good trade. I was ok with it.

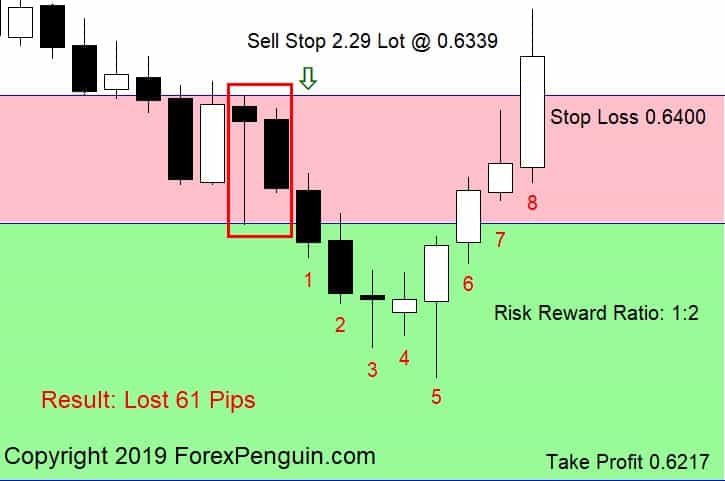

Overview Of The Setup

Below is the full image of the setup in a more compact version. You can share it with your friends and discuss this setup.

Conclusion

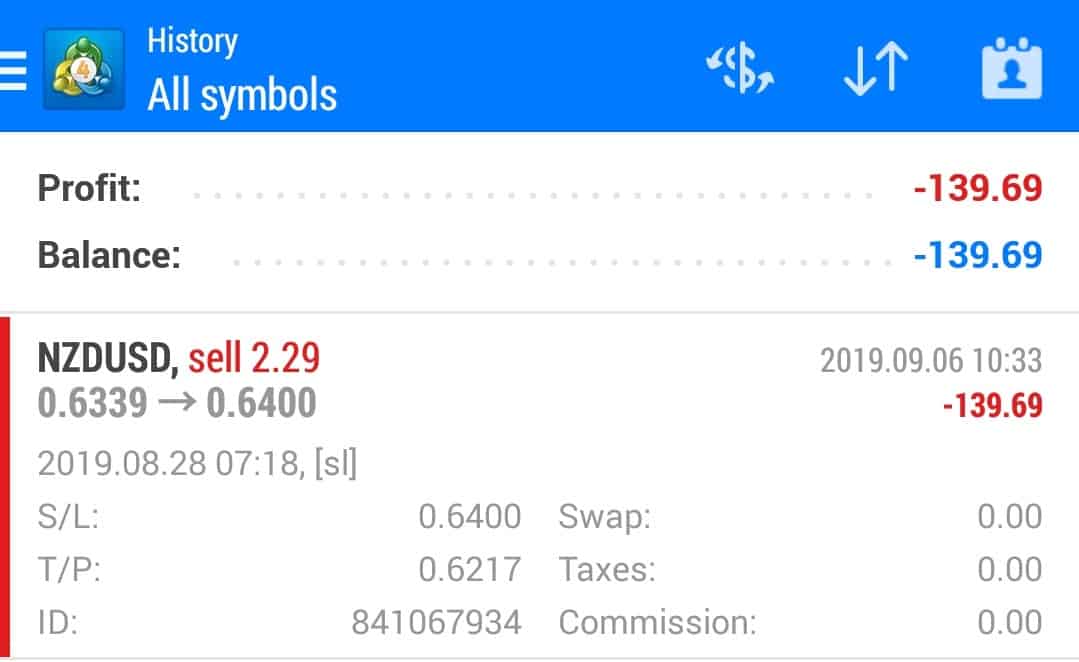

In this trade, I have lost $139.69 which is 61 pips.

What I have learned from this trade is that sometimes the setup can be very beautiful but still we can end up in a loss. There is not much reasoning for that. Trading forex is a game of probability. Every trade will eventually end up in a gain or a loss. The way we should look at this game is that both gain and loss are part of the equation.

It is good that I have set up certain rules for money management. And it is paramount that my decision is not based on any emotion. Everything is mechanically executed. If I were to trade emotionally, I would have opened a bigger lot size given that this trade seemed to be so promising in the first place. It was in a strong downtrend, and it was after a breakout of the previous consolidation. Also, it was at the support of Jan 2016. All of these were good factors.

Overall I am happy with this experience. If it did not teach me anything, I hope it teaches you something. And it is good to have a losing trade. I am still experimenting. Any loss is important as it serves the purpose of caveat. It reminds me that any system has its flaws.

We should always face the trade with an open heart. Anything could happen out there.

Nice talking to you again. I am Engedi. Please leave your comments and let me know what is your opinion about this trade.