Last Updated:

| Rank | Broker Name | Bonus Size | Expiry Date |

|---|---|---|---|

| #1 | Penguin Boom Giveaway | $50 No Deposit Bonus | On Going |

| #2 | XM Broker | XM No Deposit Bonus | On Going |

| #3 | RoboForex | Welcome Bonus 30 USD | On Going |

| #4 | HF Markets | HFM No Deposit Bonus | On Going |

| #5 | Just Markets | $30 No Deposit Bonus | On Going |

| #6 | InstaForex | $1500 no deposit bonus | On Going |

| #7 | Tickmill | $30 Welcome Account | On Going |

| #8 | GOFX | $50 No Deposit Bonus | On Going |

| #9 | Woxa | $50 No Deposit Bonus | On Going |

| #10 | LiteFinance | $50 No Deposit Bonus | On Going |

| #11 | FXGT | $30 No Deposit Bonus | On Going |

| #12 | Headway | $111 no deposit bonus | On Going |

| #13 | Baxia Markets | $30 No Deposit Bonus | On Going |

| #14 | xChief | $100 No Deposit Bonus | On Going |

| #15 | MTrading | $30 No Deposit Bonus | On Going |

| #16 | FreshForex | $2024 No Deposit Bonus | On Going |

| #17 | Admiral Markets | $100 No Deposit Bonus | On Going |

Summary: Forex No Deposit Bonus (NDB) is a tradable bonus in the real forex live account given by forex broker to the 1st time forex traders without requiring any new deposit.

This type of no-deposit bonus is popular in South Africa, Malaysia, and Indonesia. However, it is not eligible for the residents of the US, EU, and certain other jurisdictions.

All Free Forex No Deposit Bonuses in 2024

Over the years, we have worked with many forex brokers. Not all of them are as genuine as we would like them to be. Nevertheless, we do not stop our effort to work with brokers who are personally contactable. It is crucial especially when a client needs help.

For your quick view, we have compiled a list of free forex bonuses for you. These are the forex brokers that give a free bonus. You are most welcome!

Best Forex Brokers With No Deposit Bonus in 2024

1. Penguin Boom Giveaway

Penguin Boom Giveaway is a program by Forex Penguin itself. Its goal is to find forex brokers that support no deposit bonus in an ideal manner. Often we are able to get exclusive deals from reliable forex brokers. Please note that Forex Penguin itself is not a broker. We are working with good brokers to give the best no deposit bonus to our users.

Penguin Boom Giveaway No Deposit Bonus Forex 2024

2. XM Broker

XM has been in the market since 2009. XM Global Limited is one of the entities of the XM Group with its main office is in Belize City, Belize. When it comes to the no deposit bonus, XM offers one of the best bonuses in this industry. *The $50 No Deposit Bonus is not available for clients registered under the EU regulated entity of XM Group. Regulators:

- ASIC (Australia)

- CySEC (Cyprus)

- DFSA (United Arab Emirates)

- FSC (Belize)

XM Broker No Deposit Bonus Forex 2024

3. RoboForex

Roboforex is a brand owned by RoboMarkets Ltd located in Limassol, Cyprus. Since 2009 Roboforex has made its name by offering a wide range of services.

Available Assets:

- Commodities

- Cryptocurrencies

- ETF, Energies

- Equity Indices

- Forex Pairs

- Precious Metals

- Real Stocks

- Stock CFDs

Roboforex also offers copy trading where you can profit from the best traders by copying their trades.

Regulators:

- FSC (Belize)

RoboForex No Deposit Bonus Forex 2024

4. HF Markets

HFM or HF Markets (Previously known as HotForex) has been in the market since 2010. The company prides itself on having more than 60 international awards. HFM has more than 3.5 million live accounts opened. Many trading tools and educational courses as well as bonuses are available on HFM.

HF Markets No Deposit Bonus Forex 2024

5. Just Markets

Just Markets or previously known as Just Forex has customers from 197 countries and they are operating under the following core values:

- Customer First

- Passionate About Work

- Trust

- Result-Driven

- Continuous Learning

- Ownership

JustMarkets is based in Seychelles and regulated by FSA (Seychelles).

Just Markets No Deposit Bonus Forex 2024

6. InstaForex

InstaForex has its headquarter in Kaliningrad, Russia. Since 2007, it has made its name to be one of the leading forex brokers in Asia. They are offering MT4, Mt5, as well as their own proprietary trading platforms for their traders. The demo account is available and the minimum deposit is only $1.

Regulators:

- FSC (The British Virgin Islands)

InstaForex No Deposit Bonus Forex 2024

7. Tickmill

Tickmill is one of the most regulated brokers in the world. Traders can access the trading instruments via MT4. Tickmill offers a full range of educational material such as webinars, seminars, ebooks, video tutorials, infographics, market analysis, and many more.

Regulators:

- FCA (United Kingdom)

- CYSEC (Cyprus)

- FSCA (South Africa)

- FSA (Seychelles)

- LFSA (Malaysia)

Tickmill No Deposit Bonus Forex 2024

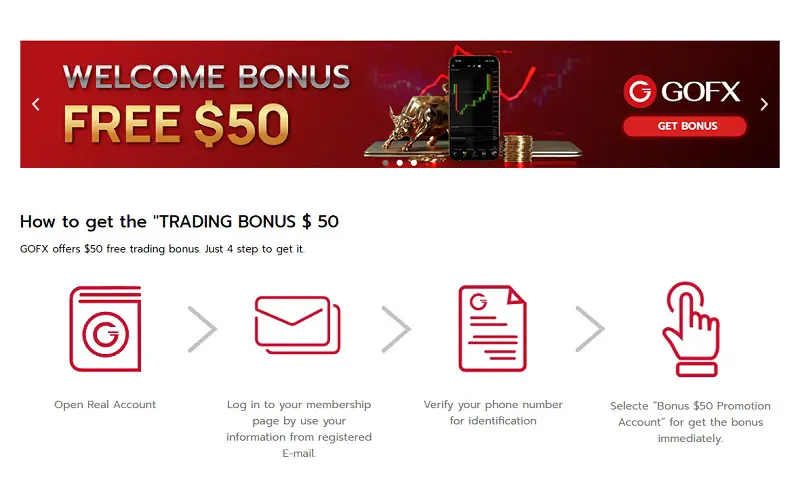

8. GOFX

GOFX, a trusted Forex broker, offers the best trading experience with a wide range of financial opportunities, including CFDs on Forex, stocks, metals, cryptocurrencies, and energies, boasting excellent trading conditions. Their support for MT4, seamless deposit and withdrawal, various account formats, daily technical analysis, and 24/7 customer support make them a preferred choice for investors.

GOFX No Deposit Bonus Forex 2024

9. Woxa

Woxa, founded in 2019, is a leading social investment network with over 100,000 users, aiming to revolutionize trading accessibility and reduce dependency on traditional institutions. Offering a diverse range of assets, low fees, and innovative features like Autocopy. Woxa prioritizes users safety and education, with a commitment to innovation and user experience, Woxa ensures fund security through segregated accounts and adheres to Islamic trade services.

Woxa No Deposit Bonus Forex 2024

10. LiteFinance

LiteFinance (formerly LiteForex) is an ECN broker established in 2005, offering Tier 1 liquidity for trading major currency pairs, commodities, stocks, and cryptocurrencies. It provides a user-friendly online platform, MetaTrader compatibility, low spreads, market execution, professional assistance, and access to analytical materials. LiteFinance emphasizes over 18 years of market presence, ECN technology, SocialTrading, an affiliate program, automated withdrawals, and easy registration with a low initial deposit.

LiteFinance No Deposit Bonus Forex 2024

11. FreshForex

Fresh Forex differentiates itself from its fellow brokers by offering a big no deposit bonus. It is founded in the year 2004. Riston Capital Ltd owns Fresh Forex and its main office is in Kingstown, St. Vincent, and the Grenadines. Fresh Forex offers its clients to trade through MT4 and MT5.

Traders can start trading with Fresh Forex for as low as $1.

FreshForex No Deposit Bonus Forex 2024

Understand No Deposit Bonus

We receive quite a few questions about no deposit bonuses:

- Do you offer the best no deposit bonus?

- Where can I get a no deposit bonus which profit can be withdrawn?

- I need a trustable forex broker for the no deposit bonus.

- Is there any no deposit bonus without verification?

- Why do I need to deposit extra money when I want to withdraw the profit made from the no deposit bonus?

- Which no deposit bonus is not a scam?

- Which broker gives a free bonus?

By the time you reach the end of this guide, you will have answers to these and other questions you might have about forex no deposit bonuses.

Master the Basics of No Deposit Bonus Forex with ForexPenguin

Table of Contents

TLDR; No time to read? Check out this quick video that explains the basics of no deposit bonuses.

Feast yourself: No Deposit Bonus Forex Youtube Video

The Ultimate Guide On How Forex No Deposit Bonus Works

Forex no deposit bonus is one of the most powerful leverages for newbie traders.

The other useful leverages are forex contests such as forex live contest and forex demo contest.

In this guide, you will find out exactly how can you utilize this type of forex bonus even in 2024.

Are you thinking of investing in forex but holding back because of the high risks involved?

Fret not.

You can practically start forex trading without any initial investments.

Because up to 10%* of active forex brokers offer no deposit bonus once you register with them.

* Note: This percentage can only be verified once Forex Penguin is done with listing down all active forex brokers.

They are the ultimate welcome package that brings a new trader online and encourages them to start trading.

Most first-timers are not willing to commit their money.

Therefore, the broker will show them the ropes by putting some money into the new account through forex promotion.

Of course, you do need to meet certain requirements to open an account with them.

You should also verify your brokers’ reputation before you accept one.

Naturally, the trader cannot withdraw the free money given to them.

They can only use it for trading as per the requirements of the broker.

In this guide, we will tell you everything that you need to know about forex no deposit bonuses.

You will also learn where you can go to find out about the latest no deposit free bonus opportunities.

What Is A Forex No Deposit Bonus?

Before we get into anything else, let’s make sure you understand what exactly the forex no deposit bonus is.

After all, even if you are getting a great deal, you are still putting some of your money on the line.

So it always pays to do your research ahead of time – and to make sure that you know what you are getting yourself into.

The forex no deposit bonus is so-called because you are not required to make any deposit before receiving it.

It is also given only once to welcome you onboard.

In the past, it used to be fairly common for people to get a forex trading free bonus.

It was smart for brokers to incentivize their customers to place more trades with them in the future.

Fortunately, the concept of a free bonus with no deposit is still quite common.

Is Forex No-Deposit Bonus A Welcome Bonus?

A forex no deposit bonus is a type of welcome bonus.

But there are other types of welcome bonuses as well that do require a deposit.

Why Do Forex Brokers Offer No Deposit Bonuses?

Brokers know that newbies are often reluctant to put their own funds on the line when first starting to trade.

As a result, they offer no deposit bonuses so that novices have a way to try trading forex without risking their own money to start.

Many newbies will wash out at this stage, but others will stick around. Over time, they may invest their own funds and become long-term customers.

Types of Forex No Deposit Welcome Bonuses

Not all forex no deposit welcome bonuses are the same. You will discover there are a number of different types:

- Regular forex no deposit bonuses

- Forex no deposit bonuses without verification

- Forex no deposit bonuses with withdrawal

- Forex no deposit bonuses with no replenishment requirement

Let’s go into a little more detail about each of these.

Regular Forex No Deposit Bonuses

The most basic type of no deposit bonus for forex is one without any special features.

To claim this type of bonus, you need to open your account and complete the verification process (see below).

You then receive the funds to trade with. After meeting the bonus conditions (we will explain these in our section on How Forex No Deposit Bonuses Work), you can usually withdraw all or part of the winnings, depending on the terms and conditions for that bonus. But you cannot withdraw the bonus itself.

No deposit bonuses that require verification and/or are not withdrawable are often larger than those with these special features.

Forex No Deposit Bonus Without Verification

When you sign up for a forex account, usually, you start by giving your name and your email address (and in some cases, your phone number) to a broker. You may then be asked to verify your identity with documentation.

You may not need to complete the verification process right away, but you will if you eventually want to make a withdrawal.

A no deposit bonus without verification is one you can claim without completing the identity verification process.

It will be immediately available for you to trade with.

That being said, it has a couple of limitations. First of all, it will be quite small. Secondly, you still need to complete the verification process before you can make any withdrawal from your account (that includes your winnings as well as the bonus, if withdrawing the bonus is permitted).

The main benefit of a no deposit bonus without verification is that it lets you get right to trading without wading through the process of providing documentation to the broker in the beginning.

Forex No Deposit Bonuses With Withdrawal

Just as you might have guessed, this type of no deposit bonus is withdrawable. You can withdraw both your winnings and the bonus itself.

Verification may or may not be required to claim the bonus, depending on the site’s rules for that bonus. But you will generally need to verify to withdraw.

Like no verification, no deposit bonuses, withdrawable no deposit bonuses for forex are usually small.

Look for this type of bonus if you want to be able to withdraw the bonus itself.

Forex No Deposit Bonuses With No Replenishment Requirement

As we will discuss in detail later on in this post, some brokers set a restriction where you have to deposit to withdraw a no deposit bonus.

You do not need to deposit money to claim and use the bonus, but when you want to withdraw the bonus and/or profits, then the requirement kicks in. You have to replenish your account with your funds, and often then meet a rollover requirement.

Thankfully, not all no deposit bonuses feature this requirement. Some just let you withdraw your winnings after you have met all other requirements.

A bonus with no replenishment requirement lets you withdraw your winnings from the no deposit bonus without first depositing your own funds.

How Large Can Forex No Deposit Bonuses Be?

The sizes for no deposit bonuses for forex can range greatly. We have seen bonuses as small as $5 or as large as $5,000.

How Forex No Deposit Bonuses Work

Below, we walk you step-by-step through how you can claim and use a forex no deposit bonus.

1. Click on any of the links on this page to visit one of our recommended forex brokers for no deposit bonuses.

2. Sign up for an account at the forex site.

3. The broker will offer you the forex no deposit bonus. Read through the terms and conditions with care. If you are comfortable with them, accept the bonus offer.

4. The broker will credit the no deposit bonus to your forex account. You will now have those funds available for trading.

5. Start making trades. You are going to need to do this in accordance with the terms and conditions for your bonus if you want to meet the turnover requirements and be eligible to withdraw your winnings and/or the bonus.

Depending on the terms and conditions set by your broker, that might mean:

- Placing a certain number of trades at a particular lot size.

- Trading certain assets (not those that are ineligible).

- Not exceeding maximum position caps.

We will discuss these possible restrictions later.

6. After you meet the turnover requirement, you should be eligible to make a withdrawal. Your broker may let you withdraw all the winnings or a percentage of them.

7. Consider depositing more money into your forex account with which to trade going forward. Also check if your broker is offering you any other bonuses.

What Can You Do With A Free Bonus No Deposit?

Now, let’s look at what taking advantage of a forex no deposit bonus can do for you.

Without having to put up any of your own money (though some brokers may require a small amount of deposit that you can get back), you can start to make trades.

This way, you can learn the ropes of forex trading, and if you make a mistake, you won’t have to pay for that error yourself.

And yes, you will be trading with actual money, not just fake, digital Monopoly money.

In fact, it can make a great transitional step between trading with virtual money in a demo account and going live with your own money.

And hey—if the site lets you withdraw your winnings and/or the bonus, you also might get some cash out of it!

Consider keeping it in your account to help you start building your forex bankroll. Of course, if you decide forex trading isn’t really for you, you can withdraw it and move on.

But What About My Profits?

So far in this guide, we have only spoken about how forex no deposit bonuses will benefit you if you lose money.

Of course, we also know you want to understand what happens if you make a profit!

Will you be able to claim it?

Or because it was never really your money in the first place, will it go right back to the broker?

One of the best things about taking advantage of these opportunities is that you will be able to keep the profits that you make.

Yes, by keeping, we mean you can withdraw the profit you have made.

You can decide to use what you have earned to invest back into trading forex.

Or, if you feel like you have caught a lucky break, but forex trading isn’t really for you?

Don’t worry – you can withdraw and move on.

Start Forex Trading Using Your Profit

If you are earning money from a no deposit bonus forex account, it means you are good.

You can now reinvest the profit you made from the no deposit account into different types of forex trading accounts.

You will be able to set your goals, as well as the amount of your initial deposit.

Some accounts allow you to start trading even if you put in as little as one dollar.

Some accounts have zero spread, as well as options that will allow you to get a precise look at your potential profit.

As you continue to gain experience in trading, you can upgrade and play around with different kinds of accounts.

In short – the sky is the limit!

Is There a Catch?

Sometimes. As we have talked about, there may be restrictions on how much of your winnings you can withdraw, and whether you can withdraw the bonus itself.

Every forex broker has its terms and conditions. These regulations are there to protect the forex broker’s best interests. Trustworthy, fair brokers are transparent about the terms and conditions governing their no deposit bonuses.

The Penguin Meter (to be released)

While claiming a no deposit bonus is a pretty straightforward process, you start to see limitations when trading with the no deposit bonus account. The final step of withdrawing the profit can be a lot more difficult than you think.

We have identified most of the roadblocks and limitations in claiming the bonus, trading with it, and withdrawing the profit.

Soon, Forex Penguin will be creating a profitability scale (Penguin Meter) that compares the difficulty levels for making use of no deposit bonuses across a range of brokers.

Stay tuned!

Hate to miss it? You can subscribe to our mailing list to receive any future updates.

Claiming A Forex No Deposit Bonus

We have identified two ways forex brokers generally work with respect to no deposit bonuses.

First model:

- Registration

- Identity Verification

- Bonus Claim

Second model:

- Registration

- Bonus Claim

- Identity Verification Upon Profit Withdrawal

You would probably prefer the second model while most forex brokers are using the first model.

The first model is beneficial to forex brokers because it works as a filter. Only serious traders will be verifying their identity.

The second model is to encourage traders who do not want to go through the hassles of verification unless they have something to gain.

Type Of Identity Verifications

1. Email Verification

Email verification is the simplest form of verification. Just click on the link sent to your inbox.

2. Phone Verification

Phone verification is also easy. The forex broker will either send you a code via SMS or voice call. It can be done within 10 seconds.

Note: The two methods above only require you to verify your account. But if you want to make a withdrawal, you will need to eventually complete one of the types of identify verification listed below.

3. Proof of Identity (POI)

Proof of identity requires you to submit a color-scanned identification document. Generally, you can submit either a passport, a national ID, or a driving license ID card.

4. Proof of Residential Address (POR)

Acceptable documents may include utility bills, bank account statements, a national ID with an address on it, or anything that can prove your residential address.

Usually, you only need to submit one of the documents mentioned above.

Other Restrictions In Claiming A Free Bonus

Forex brokers are very strict when it comes to this topic. Besides requiring verification, they also restrict the bonus to new traders only. It makes sense, of course, since that is the purpose of the entire forex bonus. If you have claimed a no deposit bonus before from the same broker, you are not eligible to claim the same type of bonus.

Not only that, but anyone sharing your residential address and the same IP address also are not allowed to sign up for the free bonus.

Before you apply for any no deposit bonus, it would be great to know whether your housemate has already done so.

Trading With The No Deposit Bonus Account

After you have claimed the bonus, it is time to trade. Since you are given a free bonus to trade, you are automatically restricted by certain rules and regulations in the trading.

Below are the common limitations when we trade using a no deposit bonus:

Maximum Lot Size

This refers to the lot size of the order. Some brokers may restrict the lot size you are allowed to use with the no deposit bonus.

From our observation, the common lot size that is allowed is 0.01 lot.

As a trader, trading with a small lot size can be disheartening because, at the same time, traders need to fulfill a certain trading volume to be eligible to withdraw profit. It is a strategy of forex brokers to incentivize traders to open more positions.

Let’s do a calculation so you can see how this works.

Disclaimer: Ahmad is a fictional character for the illustration of the no deposit bonus examples.

And the answer is 500 trades!

Ahmad will likely be trading for months before he is eligible to withdraw—and that is if he is profiting from those 500 trades. Otherwise, he will not have anything to withdraw and will need to place even more trades before he can withdraw.

Conclusion: Lot size limitation means placing lots of trades before you can withdraw after claiming a no deposit bonus.

Maximum Active Positions

To make the situation even more painful, some brokers limit their clients from having a lot of simultaneous active positions.

Sometimes the pending orders are also included when counting the active positions.

Depending on a trader’s strategies, this limiting of active positions can get in the way of certain trading techniques.

If a trader is trading based on the trend-following method, then he cannot open more positions at a different price to earn maximum profit.

Conclusion: Limitation of active positions can interfere with some strategies.

Trading Assets Limitation

Brokers sometimes restrict which assets you can trade using a no deposit bonus.

Alas, if you spot a good entry setup for a particular currency pair, you might not be able to take advantage of it.

Conclusion: Restricting trading instruments can hold you back from a profit.

Bonus Validity

This refers to the lifetime of a no deposit bonus.

The bonus will be canceled by the forex broker when it is expired.

A short bonus validity means that clients might not have enough time to meet the bonus conditions.

Conclusion: Short bonus validity can make it hard to meet the conditions for the bonus, especially if many trades are required.

Hedging Is Not Allowed

Hedging in forex trading simply means having 2 open trades in different directions.

The purpose of hedging usually is to temporarily reduce the risk of being in the market.

Sometimes hedging is used as part of a certain trading strategy.

Restricting hedging would mean that traders need to look for other trading methods.

Conclusion: Without hedging permitted, some traders may require other strategies.

Scalping Is Not Allowed

Scalping is a method that traders use to earn a small profit (usually 5-10 pips) multiple times in a day, holding each position for a very brief time.

Usually, traders use this method during high market volatility times such as during the release of economic data and news.

Scalping is popular among traders because it offers the potential to catch a lot of pips in a short time.

Of course, it is also a way to empty an account very fast. For every open position, you will have to pay some spread cost. Scalping must be used wisely if you do not want to suffer a margin call.

Conclusion: Since it is a popular method among traders, limiting its use will certainly cause trouble for traders.

Limited Leverage

What leverage means is that we can use a small amount of money to trade a larger position.

Leverage is the reason why Forex is so popular.

Limiting leverage may restrict traders’ position sizes significantly.

It also lowers trading volume, hence it will take a bigger number of trades to fulfill the withdrawal requirement.

Conclusion: Limited leverage can inconvenience traders.

Expert Advisors (EAs) Are Not Allowed

Expert advisors trading is also known as robot trading.

It simplifies the trading process a lot by automating trading tasks.

This includes opening and closing a trade, generating a tradable signal, analyzing market conditions using indicators, etc.

It is hands-free and hassle-free, and popular among novices and advanced traders alike.

Limiting the usage of EAs is like limiting the usage of an elevator – instead of pressing a button to get you to the top of the building, you are asked to walk the stairs.

Conclusion: Traders who rely on EAs will be inconvenienced by restrictions on their use.

Profit Withdrawal From The No Deposit Bonus

In most cases, you won’t be allowed to withdraw a deposit-free bonus.

So what is the point of having it? If you are making a profit from it, you can withdraw the profit!

But experiences tell us that it is not that easy to withdraw the profit you made from a free bonus.

To make your life easier and to serve as a foundation for Penguin Meter, we have created an extensive list of eligibility for profit withdrawal.

Keep in mind that the exact criteria to withdraw winnings from a no deposit bonus depend on your forex broker. Each sets its own terms and conditions.

Trading Volume

Trading volume refers to the total amount of lots that a trader has turned over.

Most forex brokers set the trading volume as the parameter of whether a trader is eligible for withdrawal. The main reason for doing that is to encourage traders to trade more.

The fact is, trading more does not mean you can earn more.

Some forex brokers even set the trading volume threshold to 100 lots. This scenario is almost like a mission impossible.

A moderate trading volume requirement such as 5 lots is fine.

But this also correlates with the maximum lot size permitted per trade and the maximum leverage allowed.

In example 1, the permitted lot size was 0.01 lot. In this situation, even a trading volume of 5 lots is too much.

Conclusion: Try and look for a low trading volume requirement when choosing a no deposit forex bonus.

Active Trading Days

An active trading day simply means that there is at least one open and closed position for the day.

Based on the example above, to achieve an active trading day, we need to close at least one position a day (Of course you cannot close a position without first opening it).

This requirement compels traders to open and close more positions.

Conclusion: Traders need to be super active in trading to fulfill active trading day requirements.

Extra Deposit Required

It is initially advertised as a no deposit bonus.

But when it comes to the profit withdrawal step, you are suddenly required to deposit a certain amount of money to be eligible for the profit withdrawal.

Do not be surprised! This is more common than you’d guess.

The purpose of the forex brokers is very clear. They want you to stay with them and trade with them. As we told you at the beginning of this guide, the main reason for the no deposit bonus is to entice you to trade in the forex market.

From our experience, traders are usually required to deposit an amount equal to their profit in this scenario.

Traders then need to trade with the deposit to fulfill a new trading volume requirement. Only then can they withdraw the bonus profits.

Conclusion: If a no deposit bonus needs a deposit at the end, why is it called no deposit bonus in the first place?

Subscribe Forex Penguin Updates

After 5 examples, Ahmad is devastated by all the rules and regulations set by the forex brokers.

He decided to stick with Forex Penguin and subscribed to the newsletter.

He is waiting for Forex Penguin to choose a better no deposit bonus.

If you are like Ahmad, please subscribe to our newsletter for more updates.

Pros and Cons of Forex No Deposit Bonuses

Now that you know more about forex no deposit bonuses and how they work, let’s quickly review their pros and cons.

Pros of Forex No Deposit Bonuses

- Start trading without making a deposit.

- Sometimes no verification is required.

- You are usually allowed to withdraw part or all of your winnings.

- Sometimes you are allowed to withdraw the bonus.

- Test drive a forex broker and try out real live trading without risking your own money.

- Claim a no deposit bonus quickly and easily in a few simple steps.

Cons of Forex No Deposit Bonuses

- There are turnover requirements and sometimes other restrictions.

- You may not be able to withdraw your full winnings and/or the bonus, depending on the bonus terms.

- No deposit bonuses are often very small (though not always).

Common Forms of No Deposit Bonus Abuse

It is not uncommon for non-deposit bonus brokers to complain about bonus abuse by their clients. As we work closely with most of the forex brokers listed on Forex Penguin, we have some insight into what is really going on behind the scenes.

Bonus abuse has often discouraged a good forex broker from offering its first-time clients these bonuses at all.

In this section, all information is written for educational purposes and it is not to be repeated. We also hope that through this guide, we can help honest forex brokers to find some ways to combat bonus abusers. That way, the no deposit bonus promotion can continue and bring benefits to genuine first-time traders.

Multiple Bonus Sign Up

You are only supposed to claim a sign-up bonus once. Alas, some traders still try to break the rules and claim bonuses multiple times.

Since most forex brokers are aware of the multiple bonus sign-up abuse, they have strict rules against it.

Unfortunately, for every rule, there will be creative ways to break it. We received reports that especially in the poorer countries, there are people who collect or buy KYC documents in bulk.

KYC stands for “Know Your Customer”. The documents include scanned copies of international passports, national id cards, government-issued driving licenses, household utility bills, bank statements, and more.

Once they have the KYC documents, it is easy for scammers to impersonate the KYC document owners and sign up for new bonuses.

Depending on market conditions, some of these bonuses could generate profits while some will lose. The abuser then can withdraw the profits.

Bonus Accounts Hedging / Arbitrage

Hedging in general means having two open positions simultaneously in the opposite direction. This creates a zero-sum game, in which there will be no loss in total.

Bonus accounts hedging or arbitrage refers to the activities of hedging two bonus accounts to gain profit from one account while losing the other one. Since the bonus is given by the broker, the account on the losing side has no monetary impact on the account holder.

On the other hand, the account that has gained profit is eligible for withdrawal.

The accounts used for the hedging can be from the same forex broker or two different brokers with almost the same bonus size and trading conditions such as leverage, minimum lot size, and stop-out level.

This method is banned by forex brokers because it is deemed cheating.

Ways For Forex Brokers To Combat Bonus Abusers

To survive in the ever-changing environment of bonus fraud, forex brokers need to be resilient and creative. Here are some of the tactics they use.

IP Address Restriction

Most forex brokers will not grant any no deposit bonus if there is an existing IP in the subnet that has already received the bonus. This is a simplified filter to discourage the same person from creating new accounts. This applies whether you are using the internet at your workplace, internet café, university, or home.

Family Members’ Restriction

Often, we encounter forex brokers who do not allow members from the same family to receive a no deposit bonus. This is because there is a high potential for a person to use his family members’ identity to acquire another no deposit bonus.

Countries Restriction

Traders in some regions are ineligible for a no deposit bonus. This is due to the high fraud activities in that country. To simplify matters, the whole nation is barred from receiving the bonus.

KYC Documents Dated Not More Than 3 Months Old

Requiring KYC documents to be no older than three months can discourage bonus abusers from creating new accounts because they have to constantly recollect or re-buy newly updated KYC documents.

Extra Deposit To Acquire A Bonus

It has become a trend that a small deposit is required to receive a no deposit bonus. This can separate genuine traders from fraudulent ones. The downside of this restriction is that it might discourage the real trader from even signing up with the broker. Plus, at this point, it is not really a “no deposit” bonus, is it?

There are many more ways that we have not mentioned here.

It is crucial to know that abusing the privilege of no deposit bonus cannot make one rich and there is no point to cheating. Legitimately profiting through trading is the only long-term way to make money with forex.

What To Look For In A No Deposit Bonus Forex Broker

Before trying out a no deposit forex bonus, make sure you pick the right broker to trade with. Here are some things to check into.

Reputation

It is always wise to look up reviews from real customers to determine whether a broker is trustworthy.

Traders will not hesitate to tell all if they lose money through underhanded behavior from a broker.

They will leave reviews so that the next person knows what they are dealing with.

Google the broker with the following keywords to reveal any hidden skeletons in the closet: “forex broker name” + review, scam, fraud. Example: Forex Broker Name Scam

You can also ask other traders directly about their experiences.

A good recommendation from an acquaintance could save you a lot of time and trouble.

Regulation

You want to work with a broker who has been licensed by an official government regulator.

A regulatory authority assures the solvency of the broker and its integrity towards its traders.

Without regulation, traders are left without any recourse in case of a dispute.

Some countries have strict rules for forex brokers. Others are less strict in their regulations.

Some notable regulators include US Commodity Futures Trading Commission (CFTC), US National Futures Association (NFA), UK Financial Conduct Authority (FCA), E.U.’s Markets in Financial Instruments Directive (MiFID), etc.

Other Considerations

Different brokers have different trading conditions and deposit bonus amounts.

Our portal ForexPenguin.com maintains up-to-date listings for brokers and what they offer for fast and easy comparisons.

Differences Between A Forex No Deposit Bonus, A Demo Account, And A Forex Deposit Bonus

Three concepts that are pretty easy to confuse are a no deposit bonus, a deposit bonus, and a demo account. Here are the differences between them.

- Forex no deposit bonus: This is the type of bonus we have been discussing in this post. You do not need to make a deposit to claim it.

- Forex deposit bonus: This is a type of bonus that does require a deposit to claim and use. The broker will match a percentage of your deposit with bonus funds.

- Demo account: This is not a bonus at all. It is simply an account loaded with virtual funds you can use to practice trading. There may or may not be limitations on a demo account.

Real Forex No Deposit Bonus Vs. The Fake One

Beware of Fake No Deposit Bonuses

While there are a lot of reputable forex brokers out there offering real no-deposit bonuses, there are also scammers out there offering fake no-deposit bonuses.

How do you tell them apart?

Check The Forex Broker’s Main Website

A legit forex website will ensure the security of its users.

One of the obvious steps is to have an SSL certificate.

It is easy to identify the SSL certificate. Check the URL.

A secure site will have HTTPS in the URL instead of HTTP.

A good forex broker will have an excellent and brandable website name.

Some fake no-deposit bonus forex sites have weird and complicated names.

The age of the forex broker is also a good determining factor.

Most scam forex brokers cannot last long.

It is a good practice to deal only with well-established forex brokers.

Responsive support from the forex broker is also super important to determine whether it is a genuine one.

Can’t find contact details? It’s a scam.

That said, some scammers do offer live chat or phone “support”. So, watch out for that.

Locate The On-site Reviews

It is a good practice for forex brokers to have a comment section on their websites.

Its purpose is to let its customers leave their testimonials.

A legit site will not be afraid to be open and transparent.

Some forex brokers might even have their forums.

You can browse the forum to see whether there are complaints and how the staff handles the complaints.

A clean record does not mean it is safe.

Bear in mind that whatever is on the brokers’ website can be easily manipulated by them.

Hence we need to check their off-site reviews as well.

Check The Off-site Reviews

A third-party review site can help us to confirm whether the offers are legit.

There are many forex brokers review sites and forums on the internet.

A simple search on Google can reveal the skeleton in the closet.

Here at Forex Penguin, we allow our users to rate and comment on every bonus which is listed here.

You can use our resources to determine whether a no deposit bonus is legit.

Social Media can be another good channel to find more information about a forex broker.

If the broker is not honest, it will not escape the bad comments of the online community.

So Which Brokers To Avoid?

Now we know a little bit about how to determine a good broker.

Common sense plays a big role here.

If the forex bonus is too good to be true, then it is not true at all.

When the support is lousy, then it is not worthy of trying.

If there are alarming comments online yet no representative is handling the issue, then it should be avoided at all costs.

With these little tips, hopefully, you can find the right no deposit bonus.

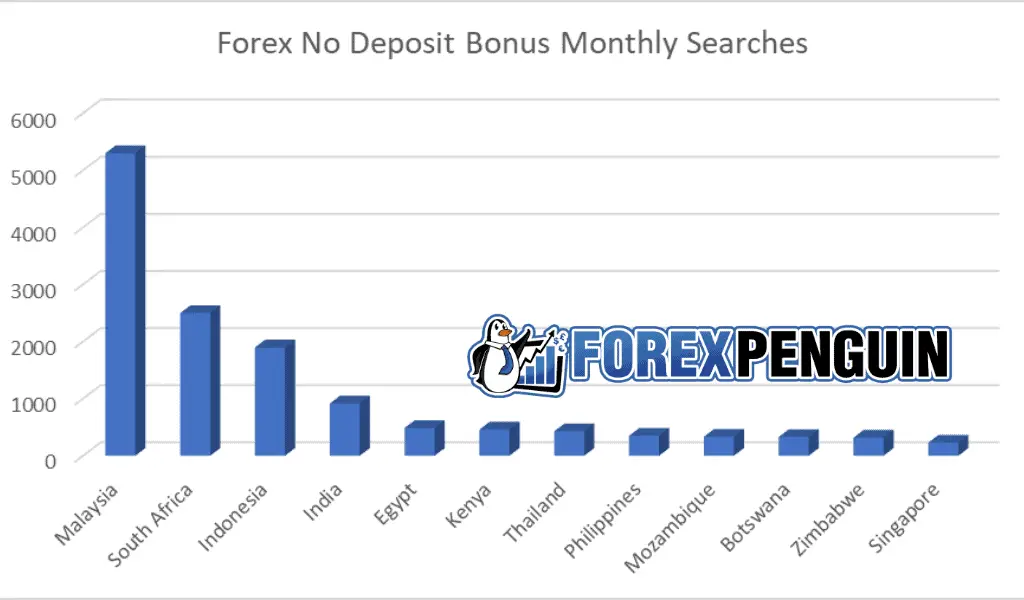

Top 12 Most Popular Countries For No Deposit Forex Bonus

Based on the Google keyword planner, we have identified the 12 top countries where no deposit forex bonuses are popular.

- Malaysia

- South Africa

- Indonesia

- India

- Egypt

- Kenya

- Thailand

- Philippines

- Mozambique

- Botswana

- Zimbabwe

- Singapore

We have created a chart below to better illustrate the relative popularity of no deposit bonuses in these countries.

According to the statistics, we believe there is a great need for forex bonuses in the market.

Forex brokers should fill in the gap and provide their users with good and fair no deposit bonuses.

Free Bonus Is Not Free Money

In case we didn’t make it clear enough, a forex no deposit bonus is not free money.

The broker sets the pace and conditions for you to follow, to be eligible, and to participate.

They are also looking forward to forging a long-term relationship with you. That is why they encourage your participation by giving you money to help you start.

You don’t have to spend a single dime to claim the bonus. But if you claim one, you do have to earn the right to withdraw your winnings by meeting the turnover requirements.

Think of it as the initial outlay for a venture that you are going to claim only if you successfully launch your business.

Essentially, your broker is giving you free money—but only if you have what it takes to earn it through regular trading and patience.

Are You Ever Going To Pay It Back?

The forex no deposit bonus is not a loan.

The profits are all yours if you can earn them by meeting the specified requirements. If you are allowed to withdraw the bonus itself, it is also yours after you meet the requirements.

As a newbie, this bonus eliminates your worry of losing money at the beginning of your forex trading venture.

It also allows those who have the skills but don’t have the capital to give it a shot.

The bonus is usually a small amount, but it is enough for small trades, depending on your broker.

If the first three or so trades are successful, you will be bold enough to add a little of your own capital.

Depending on your broker, the new capital could also qualify for a new deposit bonus.

So, there you go, newbie trader!

This bonus eliminates the risk associated with forex trading as a beginner. You might as well give it a try.

Understanding Forex No Deposit Bonus: What’s Next?

We hope this guide has helped you to better understand not just what a forex no deposit bonus is, but also why it’s such an awesome way to get into the market.

You have nothing to lose – but you might also discover a lucrative and fun new pursuit.

Of course, getting a grasp on no deposit-free bonus opportunities is just one small part of the larger forex world.

Do you want to hear about our promotional updates in the forex world, participate in a demo contest, and much more? Then subscribe to our newsletter.

Frequently Asked Questions About The No Deposit Bonus

✅ What is a forex no deposit bonus?

Forex no deposit bonus is a tradable bonus in a real forex live account given by forex brokers to first-time forex traders without requiring any new deposit.

✅What is NDB in Forex?

It is the acronym for No Deposit Bonus.

✅ Is there any no deposit bonus without verification?

Yes, Instaforex is offering a no deposit bonus without verification.

✅ What is the best no deposit bonus?

Penguin Boom Giveaway aims to be the best forex no deposit bonus. However, it is still under development and traders can sign up for the waiting list. Currently, the top brokers we recommend offering the best bonuses include XM, Instaforex, Agea, and Vantage Markets.

✅ What are the terms and conditions to get a no deposit bonus?

Each broker has its own set of terms and conditions. It is best to refer to those terms before applying for the forex bonus. Some examples of terms and conditions include bonus validity, trading volumes, extra deposit, and country of origin.

✅ How do I withdraw the no deposit bonus?

Generally, you cannot withdraw a no deposit bonus because it is an exclusive opportunity for first-time users to experience trading. Nevertheless, the profit made from the no deposit bonus trading can be withdrawn upon fulfillment of the terms and conditions. Some no deposit bonuses may also be withdrawable, though they are generally very small.

✅ Can I do forex trading without money?

Yes, you can do so by looking for no deposit bonus offers by forex brokers. It is a good practice to check the terms and conditions of the no deposit bonus before proceeding.

That said, you are not going to be able to build up a large account this way. If you are looking for serious profit, you are going to need to put your own capital into your account eventually.

✅ How do I get the no deposit bonus for forex?

Generally, you will have to open an account with the broker, go through the verification process and apply for the no deposit bonus once your account is verified. Keep in mind that every broker has its own process as well as individual terms and conditions.

✅ What is the amount of no deposit bonus that I can get?

The amount of no deposit bonus typically ranges from $5 to $5,000. The most common amounts are $30, $50, and $100.

✅ Can I actually make money with a no deposit bonus?

Yes, provided that you have sufficient trading skills and a good no deposit bonus.

✅ Why am I not eligible for the no deposit bonus?

You may always refer to the terms and conditions of your broker of choice as there are certain eligibility criteria to fulfill. These terms help to prevent fraud. Most commonly, you are not eligible if someone has already obtained the no-deposit bonus using a similar or nearby IP address (family members or neighbors). Other examples include country restrictions or if you already have an existing trading account.

Latest No Deposit Bonus Forex 2024

We post daily forex no deposit bonuses from various brokers, so we encourage you to check us out every day for all available offers.

Keep checking back with us for the forex bonuses and news you can’t afford to miss.

Happy trading!

Is this guide helpful? Please share it.